Research and Development (R&D) is crucial for the growth and future success of research-based pharma companies. To maintain their R&D organisations efficient, pharmaceutical companies started to hedge the potential of open innovation to cut R&D costs and to access external knowledge. These new strategies could be divided into several categories: open source, innovation centres, crowd sourcing and virtual R&D.

R&D has traditionally been and will continue to be (probably even more) crucial for the growth and future success of research-based pharma companies. Given the industries’ traditional R&D strategy, that was built on internal innovation, and the rising regulatory hurdles, pharma companies continuously increased their financial input into R&D related work with the hope to produce a higher nominal R&D output. Today, the total worldwide R&D spend of pharmaceutical and biotechnology companies amounts to US$150 billion, the global average R&D rate (R&D as per cent of sales) of pharma and biotech companies is 10.6 per cent (for the big players up to 20 per cent) and 15 companies in the top 30 R&D investors worldwide based on their R&D rate are pharma companies [1]. Two simple comparisons with the automotive and the chemical sectors illustrate the importance of R&D in the pharma industry:

• The top pharma companies (figures in brackets= number of employees) Novartis (136,000), Roche (94,000) and Pfizer (90,000) invest comparable amounts in their R&D as the much larger car manufacturers Volkswagen (642,000), Daimler (290,000) and Toyota (338,000). This is remarkable as both industries’ growth depends to the same degree on product innovation. And it is even more surprising as in addition the automotive industry faces major R&D challenges such as new mobility concepts or the technology shift from the combustion engine to the electric motor that should impact the car companies’ R&D investments significantly.

• Or take the example of BASF, the world leader in chemistry that also heavily benefits from innovation. With its 115,000 employees (total sales EUR 64.5 billion) it invests significantly less in R&D (EUR 1.8 billion) than the multiple times smaller (relating to number of employees and total sales) Boehringer Ingelheim (45,000 employees; EUR 15.9 billion sales; EUR 3.1 billion R&D costs), a German leader in the pharma sector.

Why are the R&D costs of pharma so high? Relatively low R&D success rates and long development timelines explain to a large extent pharma’s high R&D costs. The combined probability of technical and regulatory success for all R&D phases is on average 4 per cent[2]. This low success rate is based on various reasons, comprising the lack of efficacy or safety issues of new drug candidates, changing R&D strategies that impact the R&D project portfolio negatively or business reasons that let die commercially unattractive new drug concepts. R&D lasts on average more than 10 years (not including the time for basic research or postapproval Phase IV trials). Due to its direct link to opportunity cost and reduction of the patent life, the long time-lapse for pharma R&D impacts various other factors negatively: the total R&D costs, the risk of industry rivalry, and the uncertainties of generic competition. Any investment in a new drug project before regulatory approval happens many years before drug commercialisation and, thus, needs to be capitalised for years. This capitalisation of R&D costs leads to an enormous increase in the total R&D costs. The long period for pharma R&D increases the risk that competitors may be faster to market, and, in consequence, may reduce the market potential of a new drug. And the typical early patent application filing for the drug substance in lead discovery in combination with the long timelines usually results in an effective patent term of 8-12 years after market launch. Any delay before market authorisation negatively impacts the effective date of generic competition and, thus, the commercial success of a drug. Both the low success rate of pharma R&D in combination with long development timelines result in enormously high costs for discovering and developing a new drug. Older calculations (not including all costs of pharma R&D)indicate that the cost per new molecular entity (NME) are at around USD1.8 billion [2]. Newer analyses found significantly higher cost for drug innovation of US$3 billion and more [3].

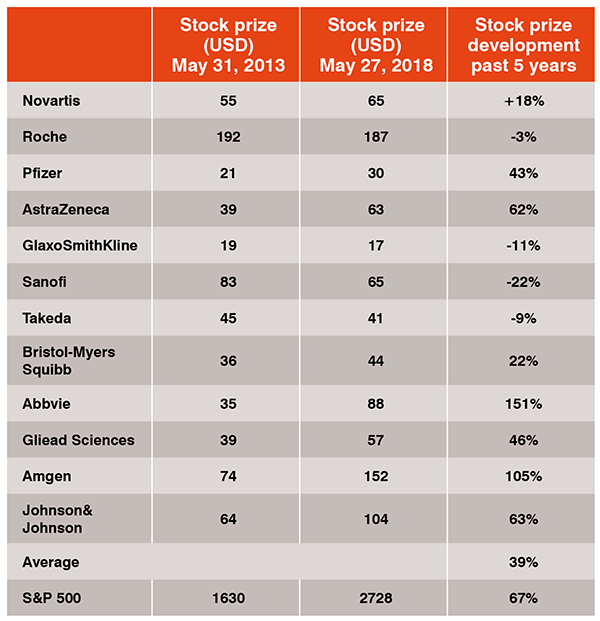

Pharma’s high R&D investment (input) as such is only a part of the problem. The real issue becomes apparent when one compares(1) the inputto (2) the output-figures of pharma companies, the number of new drugs launched, to (3) the investors’ expectations for an adequate return-on-R&D investment. In fact, the industry as a whole did not live up to these expectations and failed to come up with a reasonable output/input-ratio that has been rated positively by investors. In consequence, the average stock prize of the top twelve pharma companies (+39 per cent) developed below the S&P 500 (+67 per cent) or the German DAX (+66 per cent) in the past 5 years (Table 1).More concrete, most of the top pharmaceutical companies did not launch enough new drugs in the past years to meet their growth expectations only by product innovation[4]. And those market actors which were successful in providing NMEs, needed to invest so much in R&D and marketing for new products that they obviously find themselves in an R&D double windmill (the enormous investments in high-risk R&D today necessitate high R&D costs tomorrow). In consequence, the output/input-mismatch put a principle questionmark on the sustainability of the traditional pharma R&D model that is based on hiring the best scientists, doing R&D by the company itself, developing own ideas, generating own IP and trying to be first-to-market. At least some of the top pharma companies challenged their R&D models and realised that there is a need to open up their R&D organisations towards innovation that comes from external sources.

Today, pharma companies use both internal and external ideas to solve problems and to provide innovation to markets. Internally, they ask their scientists for new ideas and improvements. Or they look for existing technical solutions within the whole project portfolio (and not only within a technical field) that might be transferrable to the given problem. Or they ask their customers to get proposals for new ideas. At once, pharma companies analyse their competitors’

situations for troubleshooting. Or they collaborate with competitors to learn how to circumvent risks and problems. Or they even go beyond the pharma sector and search in other industries for stimulation of how to solve problems. More specifically, pharma companies use open innovation models, such as open source, crowd sourcing, public-privatepartnerships and innovation centres to broaden their innovation basis, to access external knowledge and to bring down R&D costs:

• Open source approaches have been used to access knowledge of worldwide experts in a joint project approach. Examples are the Human Genome Project or various initiatives to develop drugs for neglected diseases, such as the Special Program for Research and Training in Tropical Diseases (http://www.who.

int/tdr/en/), the Medicines for Malaria Venture (https://www.mmv.org), the Global Alliance for Tuberculosis Drug Development (https://www.tballiance.org), or the Drugs for Neglected Diseases Initiative (https://www.dndi.org). These examples show both the important social function that the pharmaceutical industry has to play in developing new medications in financially unattractive markets and its ambition to experiment with new open R&D models.

• Pharma companies use crowdsourcing to post questions or problems to a large group of external experts (that are not part of the company) and invite them to provide solutions. The external experts solve the problems in return for financial gratification. Some of the most known examples are Eli Lilly’s Innocentive, YourEncore, and Open Innovation Drug Discovery (https://openinnovation.lilly.com/dd/https://openinnovation.lilly.com/dd), AstraZeneca’s open innovation platform (https://openinnovation.astrazeneca.com), or Bayer HealthCare’s Grants4Targets (https://grants4targets.bayer.com), Grants4Leads(http://www.grants4leads.com), and Grants4Apps (https://www.grants4apps.com). Other pharma companies, such as Novartis, Merck & Co., Sanofi or GlaxoSmithKline (GSK) use this open innovation model in more project-related applications, such as to access patient information.

• Public-private-partnerships are a kind of research collaboration of academic or publicly funded institutions, charities, and pharmaceutical companies. The industry is actively supporting this open innovation models, as it helps to integrate external (academic) knowledge while sharing risks amongst the partners in research fields that are either outside the main franchises of the pharma companies or are exploratory. In addition, pharma companies can access public funding and affecting public reputation positively. In the past years, this open innovation model got more attention in the industry and numerous initiative were started, such as the Biomarker Consortium (source: www. biomarkerconsortium.org), the Innovative Medicine Initiative (www.imi.europe.eu), the Serious Adverse Events Consortium (www.saeconsortium.org), or the FDA initiated the Critical Path Initiative (https://www.fda.gov/ScienceResearch/SpecialTopics/CriticalPathInitiative/default.htm).

• Another new type of open innovation is the innovation centre, which is an advancement of the traditional research collaboration, as it doesn’t focus on a specific project task or technology transfer, but on the long-term integration of external competencies usually providedby a world-class academic institution. Innovation centres allow the access of external cutting-edge know-how and resources that could not be easily built internally. Pfizer with its Centers for Therapeutic Innovation, GSK with the Center of Excellence for External Drug Discovery or the Takeda’s Center for IPS Cell Research Application at Kyoto University are the most prominent examples of the industry. Bayer Healthcare, the German Merck or Johnson & Johnson, have also experimented with this new concept with innovation centres in the U.S. and Germany. And Novartis had a pioneering role with its long-lasting partnerships with the Massachusetts Institute of Technology (MIT) or the Dana-Farber Cancer Institute, just to name two examples.

The advantages of all these open innovation models are the access new ideas and external knowledge, the acquisition of new technologies, the problem solving and the reduction of overhead costs (and hence of R&D costs). The related risks are the typical challenges in project, alliance and IP management that come along with all kinds of external partnerships. Or companies need to deal with the uncertainties of their own staff that appear in the not-invented-here and not-sold-here syndromes.

What is surprising, however, that probably the most effective new form of open innovation, at least with respect to accessing external knowledge und cutting R&D costs, the virtual R&D model, has so far only be applied by Eli Lilly and a small number of mid-sized pharma companies, such as Shire [5] or Debiopharm [6]. When virtualising R&D, companies aim at reducing complexity and increasing efficiency by focusing on internal core competencies that provide a competitive edge, reducing fixed overhead costs, increasing projects-dedicated budgets, and selecting the best external service providers to leverage economies of scale and scope and to access the best quality. Eli Lilly applied that open innovation model when starting Chorus in 2002. Chorus manages a considerable portfolio of around 15 drug projects with worldwide clinical trials with a small number internal staff of 40 full-time equivalents[7]. Apparently, it delivers a higher output when compared with the traditional Eli Lilly R&D organisation: (1) a higher probability of success for the proof-of-concept trials (54 per cent Chorus vs. 29 per cent traditional Eli Lilly) and (2) a 3 to 10 times higher overall productivity.

The advantages of virtualising R&D are clear and proof-of-principle is given by the success of Chorus, Debiopharm and Shire. The question is why other pharma companies have not yet implemented this open innovation model? The answer to this question is as apparently: there is too much risk to fail! Changing an organisation’s R&D model to a completely new one is a suicide mission as the old R&D strategy is hardwired in the DNA of the organisation and the culture of its people. And the costs of gradually restructuring a global R&D group located at different sites to become a slim virtual organisation would be substantial. The three solutions to this are:

• The start-up model: Start a new organisation that is geographically and structurally separate from the original R&D organisation. If the virtual entity succeeds, gradually redirect investment funds towards it and away from the old operations.

• The clear-cut model: Recruit an expert team from the old R&D organisation and from outside the company to start the new virtual R&D and downsize or close the old organisation.

• The fund model: Establish an R&D fund that is company independent and sponsors new external ideas.

Given the situation that pharma companies have limited influence on the environmental spheres, pharma is forced to improve their R&D output/input-ratio either by reducing costs as a combination of releasing relevant R&D personnel and out-sourcing project-related R&D activities to service providers in low-cost countries or to find new of ways for R&D, such as crowd sourcing, public-privatepartnerships, innovation centres or virtual R&D. The examples illustrated herein provide an indication that these new open innovation models can help to reduce R&D costs and increase access to knowledge and new technologies. In any case, any new R&D model needs to be linked to a new open-minded culture of how the new strategy is implemented. Thus, to leverage from these models, pharmaceutical companies need to make the following cultural modifications:

• hire people who are open-minded and that know of how to work with different stakeholders and different cultures

• make clear that innovation need to be accessed globally and does not come from internal source only

• push back not-invented-here and notsold-here syndromes

• promote the entrepreneurial spirit in the company

• stimulate the openness in the organisation to share ideas

• encourage teamwork

• develop managerial skills to better utilise external partnerships

• increase the absorptive capacities by implementing open innovation processes, and

• form more strategic alliances and active involvements in innovation networks.

Literature

[1] European Commission—Joint Research Centre. The 2017 EU Industrial R&D investment scoreboard. http://iri.jrc.ec.europa.eu/scoreboard17.html.

[2] Paul SM, et al. How to improve R&D productivity: the pharmaceutical industry’s grand challenge. Nature Reviews Drug Discovery,2010;9:203–14.

[3] Harper M. The truly staggering cost of inventing new drugs. 2012. http://www.forbes.com/sites/matthewherper/2012/02/10/the-truly-staggering-cost-of-inventingnewdrugs/#2ce906714477.

[4] Schuhmacher A et al. Changing R&D models in research-based pharma companies. Journal of Translational Medicine, 2016;14:105; doi: 10.1186/s12967-016-

0838-4.

[5] Schuhmacher A, Germann PG, Trill H, Gassmann O. Models for open innovation in the pharmaceutical industry. Drug Discovery Today, 2010;18: 1133-1137

[6] Schuhmacher A, Gassmann O, McCracken N, Hinder M. Open innovation and external sources of innovation. An opportunity to fuel the R&D pipeline and enhance decision making? Journal of Translational Medicine. Journal of Translational Medicine, 2018; 16:119.doi:10.1186/s12967-018-1499-2

[7] Owens PK. A decade of innovation in pharmaceutical R&D: the Chorus model. Nature Reviews Drug Discovery, 2015;14:17–28.