With the increasing popularity of global and regional trials in Japan, most global pharma companies are looking to develop as many compounds in Japan as possible. Yet, with limits to ‘headcount increases’, companies face limited options to achieve their business goals.

Japan remains the second largest national market for pharmaceuticals at 11% of the global market-as defined by IMS. And yet, there remain varying opinions about the status of Japan's pharmaceutical industry. Japan's unique regulatory requirements are often cited as a particular cause of frustration by multinationals. However, the Japanese government has taken a very keen interest in improving its regulatory review performance as well as that of the clinical trial infrastructure-much of which promises to improve the situation in Japan in the near future. In particular, the "drug lag"-the delay of introducing new drug products-continues to plague patients here.

Now, global companies are trying to get as many products as possible into the Japanese market as quickly as possible to minimise this drug lag. And while they are doing this, the impact of shrinking global margins is often to freeze headcount in places like Japan. Therefore, CROs operating in the Japanese market have enjoyed a surge.

However, the CRO market in Japan, after starting from virtually nothing in the early 90s and growing since then, unfortunately is still immature in both capability and capacity. The increasing workload which global companies must deal with-in combination with the immaturity of the Japanese outsourcing market-leaves two diametrically opposed options for the pharmaceutical companies. The first option is to significantly improve internal productivity in order to enable the increased workload with the same staffing levels. The other option is to establish truly non-procurement-driven partnerships with CROs. These pose viable, yet challenging, alternatives.

For those unfamiliar with the Japanese pharmaceutical market, it must be surprising to learn that a mere 22 percent of the drugs launched across the world between 2002 and 2006 are available to Japanese patients and that up to 40 percent of the world's top ninety-nine compounds in the market today are not available in Japan. While this seems dire, corrections are being made to close this gap; often called the "drug lag." This means that there is a large number of proven products to be developed and approved in Japan. Meanwhile, increasing competition, blockbuster patent expirations and new technologies are driving an increasing number of compounds into development.

So, it is clear there are lot of compounds which could be developed in Japan. And companies are trying to do just that with a likely result of diminishing the magnitude of the "drug lag" significantly. Yet, it is the same global competition which is driving pipeline growth that is limiting headcount growth as well. While the era of the blockbusters allowed big pharmaceutical companies to significantly increase the headcount, today's pressures demand restraint. So companies are trying to develop a large number of compounds in Japan, without increasing headcount. In addition, the regulatory requirements in Japan demand that clinical data be collected on Japanese subjects in order to accomplish registration, thus creating significant pressure on both corporate managers and functional managers involved in late-stage drug development. From a global company's perspective, the first reaction is to look to outsourcing to save the day.

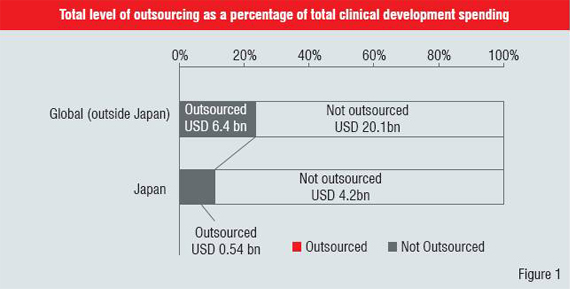

Unfortunately, the market1 for outsourcing services in late-stage clinical development (later than Phase IIa) is not yet mature. To understand why this is the case, we need to go back in time about a decade. While several of the major CROs were founded in the early 90s, it took Japan's late adoption of International Committee on Harmonization (ICH) E6 guidelines on Good Clinical Practices (GCP) in 1997 to kick-off the growth cycle which continues to this day. So the industry is relatively young in Japan. But, from a business perspective, market maturity is not driven by age. If we look at the total level of outsourcing as a percentage of total clinical development spending, for Japan, we see that it is about half that spent outside Japan (Figure 1). Unfortunately, very little research has been done on this market.

As a result, in late 2006 and early 2007, PRTM2 undertook an in-depth survey of this market in Japan. More than 50 pharmaceutical companies, CROs, medical device companies and other related companies participated. The survey investigated the various activities in clinical development and sought to understand the maturity of this important market.

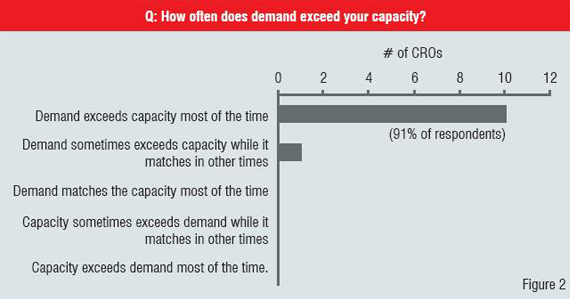

The maturity of a market can be judged through many measures. In this survey3, PRTM examined maturity as represented by multiple willing and able suppliers in combination with willing and ready buyers. In looking at the relative maturity levels of the specific service areas in clinical research, we estimate that a few services, such as randomisation and patient registration, services are truly mature in Japan. The most commonly outsourced services on a global scale such as monitoring, biostatistics and data management are still in a growth phase. This means that demand regularly outpaces supply as can be seen in Figure 2. In fact, many CROs are currently quoting a nine-month or more waiting period for monitoring resources. Other key outsourcing areas, such as protocol development, common technical document (CTD) development and filing preparation are in the early stages of development as services in Japan.

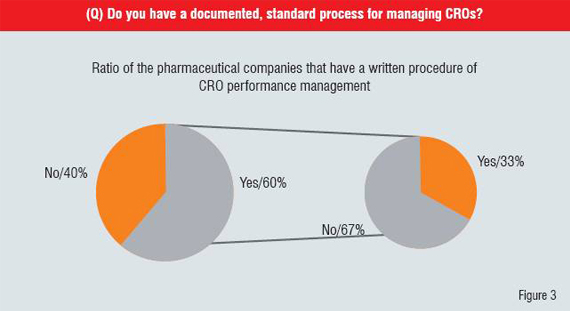

Meanwhile, the practices of managing interactions between CROs and pharmaceutical companies are also immature. Global pharmaceutical companies' management process elements including selection, contracting, performance management and evaluation were originally developed in headquarters and transferred to Japanese subsidiaries assuming that outsourcing market is as mature as elsewhere. Not surprisingly, survey results also reveal that managing CROs performance is critical for pharmaceutical companies to receive reasonable level of services (Figure 3).

The survey reveals that large pharmaceutical companies are just beginning to bring more formal procurement-like systems into Japan to improve how they interact with outsourcing vendors. Unfortunately, this also means that some are tending to treat clinical outsourcing as a traditional procurement transaction, focussed on short-term cost alone. Unfortunately, for such procurement transactions to work effectively, a mature marketplace is needed. Meanwhile, many of the smaller firms are yet to "professionalise" their outsourcing practices. As a result, pharmaceutical companies, as a whole, report receiving unsatisfactory services at unsatisfactory price.

PRTM believes that sourcing in an immature market, in particular requires top management's involvement to evaluate the two apparent strategic options in order to fulfill their development needs:

With each of these alternatives, it is true that there are cases of success and failure. Much of that can be attributed to the effective execution of a strategy. Yet, it is up to the management of each firm to find its way between these two extremes. The characteristics of management and its staff will dictate which approach or combination thereof makes the most sense.

Faced with mounting pressures to do more with less people, development managers at pharmaceutical companies operating in Japan face some tough choices ahead. We've seen that many organisations are inefficient and could use a strong dose of option (1) above to improve efficiency. Meanwhile, stories abound regarding companies who have tried and failed at option (2). We argue that the proof in these cases is in the execution of the strategy at these companies. So far, results are yet to be seen in any consistent manner in the industry. And, while there are many management styles, there are equally as many choices along the spectrum outlined above. In the end, then each company must choose its own course. Some will opt for organisational excellence and some will move completely in the other direction. Neither option is right nor wrong. But, it is important to be wary of execution and trying to fit Japan into a box defined by other markets.