Clinical trial supply chain will play a significant role in launch of new products in a globalised environment of clinical trials and clinical supplies manufacturing.

The lead time for conducting clinical trials is one of the critical paths in the launch of a new product for life sciences companies, while providing clinical supplies at the right time at the right site is the most daunting challenge faced by the clinical operations team. Changes in the trial design and uncertainty in the demand of clinical supplies due to unpredictable patient retention have been the traditional challenges faced by the clinical team, which typically lacked a formal process or cross-functional collaboration. Over the years, complexity of launching a new product has increased exponentially thanks to the heightened competition, increased pricing pressure and globalisation of clinical trials, as well as sourcing of clinical supplies. Adding to the challenge, clinical trials have grown larger in size and longer in duration (Figure 1). However, heightened regulatory compliance requirements (e.g., quality and global trade) and consumer awareness of multiple drug therapy options have reduced the margin of error during clinical trials. Last but not the least, the success of bio-pharmaceutical companies has put enormous pressure on the traditional blockbuster model of large pharma companies, which is reflected in the reduced budget allocation for clinical trials and stringent metrics for the successful launch of new product into the market. One solution for achieving this is to incorporate a closed-loop supply chain that connects the various functions in a real-time fashion. This is an imperative first step in the process of clinical supply chain performance improvement, leading to reductions in time to launch a new product in the market—the ultimate goal for any pharmaceutical organisation.

Clinical trial supply chain benchmarking study

A recent study by AMR Research, in conjunction with BearingPoint, surveyed executives working for mid-size to large companies in life sciences or medical device industries from North America to Europe that are directly involved in supply chain-related activities. The results of the study illustrate the criticality of Clinical Trial Supply Chain (CTSC) performance in reducing the lead time of launching new products in the market.

Only 36 per cent of the companies surveyed admitted having conducted planning meetings to translate their demand to operational plan. Just 23 per cent of the companies confirmed that their current supply chain processes are effective, which explained why more than two-thirds of the companies outsourced their supply chain to meet their objectives of agility, cost and expertise. Additionally, nearly half of the companies confirmed the difficulty in establishing global operational procedures. This explains the slow response by the research and development organisations to deal with challenges around clinical supply chain management. Instead of trying to reinvent the wheel, there is an opportunity to leverage lessons learned by other industries in improving their supply chain, identify the area of similarities, and selectively apply them to the clinical environment. The first safe step would be to look at closing the supply chain loop to ensure tighter integration across functions to collectively respond to the challenge, rather than treating this as a supply chain problem.

Current industry response to meet the challenge

Several companies have taken the lead in making significant changes to their CTSC capability. These organisations have taken different approaches to dealing with the issue and have tasted varying degrees of success. These approaches entail adjusting the process, organisation, strategy and technology.

Process – Be collaborative

Realising the significance of improved demand forecasting, some companies have implemented Sales and Operations Planning (S&OP) type of models with a formal collaborative process between clinical research and supply chain teams. There are weekly meetings conducted between the teams sharing demand and supply data on a more frequent basis, leading to effective planning and utilisation of resources in the downstream processes. This is where decisions related to changes in trial design / logistics are made jointly, keeping in mind the financial implications, as well as the increase in supply chain lead times that has helped manage the clinical trial within budget.

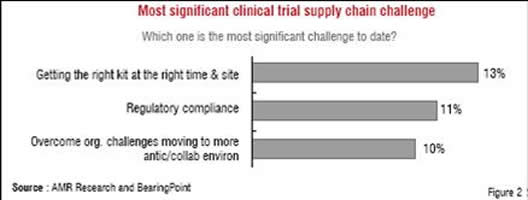

As observed in Figure 2, regulatory compliance and collaborative environment are the other key challenges in a globalised world, where documentation requirements are becoming very stringent to avoid delays in shipment or hold-ups in customs clearance. R&D organisations have started implementing formal processes to deal with the above as they have been recognised as major risk areas from a supply chain perspective.

Organisation – Provide dedicated support

The role and definition of CTSC organisations have evolved over time. Recognising the need for cleaner upstream processes, certified supply chain professionals are leading some of the transformation programmes to implement formal planning and forecasting processes. Supply chain coordinators support various protocols by therapeutic area and work collaboratively in a matrix organisation of plant supervisors who are responsible for scheduling and managing manufacturing capacities of clinical supplies. Some companies are applying innovative strategies to leverage key elements of commercial supply chain organisations and outsourcing to manage the sourcing, packaging, labelling and distribution of supplies to deal with the complexities of global demand and supply networks.

Technology – Invest and integrate

Technology is one area where R&D organisations have not made much investment. The CTSC functions are mainly supported by use of Microsoft® Excel spreadsheets to homegrown applications loosely interfaced with data inputs from Interactive Voice Response Systems (IVRS) and back-end manufacturing and sourcing systems. With this, much of the business communication happens over phone and e-mail. Thanks to their dedicated effort, clinical operations teams have been able to maintain a high level of performance to get the supplies on-time to their clinical sites.

Despite these attempts to use technology to provide scalability, companies have not achieved a high level of integration across the following packaged applications: Clinical Trial Management Systems, IVRS, third-party service providers systems. This has increased the risk exposure in the areas of inventory visibility, traceability, returns and reconciliation at sites.

Strategy – Find the right one

Multiple strategies exist for approaching the CTSC. These include the selective or complete outsourcing of clinical operations—fostering extensive collaboration between the supply chain and clinical research teams early on in the trial design phase to factor in their feedback to mitigate key supply chain risks / constraints during the process, all the way up to using delivery postponement strategies and implementing concepts of pooled supplies and on-demand labelling.

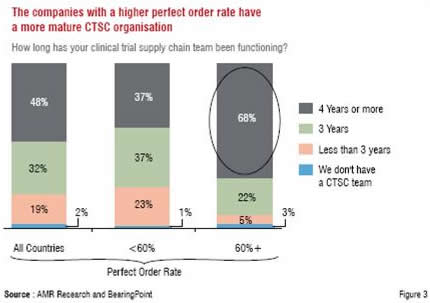

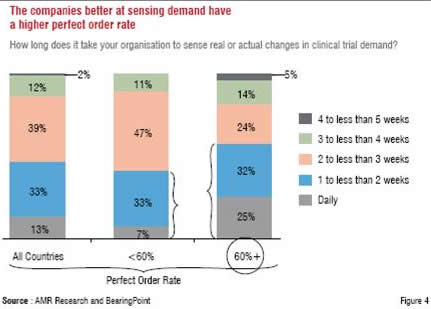

As can be observed in Figure 3 and Figure 4, which highlight additional findings of the AMR Research study, these strategies have yielded encouraging results in the form of a mature CTSC organisation leading to a higher perfect order rate.

So, why do life sciences companies need to implement a future state clinical supply chain that is agile, robust, reliable, scalable and efficient? What are the key elements of such an

organisation?

The recommended solution – Closed loop clinical supply chain

As the name suggests, the key aspect of this model is “closed loop,” which means effective real-time communication across all functions to factor each other’s constraints and operate on a single version of truth at all times. In simple terms, this requires the following key elements to be implemented (Figure 5).

Sales and operations planning: Again, this is a key element to improve the upstream process in clinical supply chain. When combined with a creative requirements planning strategy (Materials Requirement Planning / Consumption Based Planning), these processes can save significant amount of time and effort for the clinical supply chain coordinators to focus on key tasks of efficient planning and timely communication to help optimise resources and costs at all levels.

Manufacturing integration (MI): A tighter integration between manufacturing, planning and clinical research teams would enable real-time information exchange on delays due to capacity or resource constraints between shop supervisors and planning coordinators. This will help the clinical research teams to take appropriate action at their end in a proactive manner and eliminate waste or redundancy in the process. For example, patient visits can be rescheduled well in advance or alternative plans can be made to ensure timely supplies to sites.

Supplier collaboration (SC): This helps in streamlining the procurement process and making it more efficient by allowing communication of variability in supply and demand in a timely manner. Additionally, this helps in minimising various issues around documentation and compliance requirements by ensuring exchange of accurate and complete information about the products (clinical supplies) across all parties, such as Contract Manufacturers and Contract Research Organisations (CROs) involved in the process. This is particularly important in the context of globalisation or outsourcing, where the number of parties involved in the process is increasing.

The Rubik’s cube of CTSC

For large companies conducting multiple global trials at any given point of time, the list of challenges keep growing with the advent of globalisation (culture, language and infrastructure), outsourcing (additional process steps and IP concerns), and above all, changes to the concepts of trial design—with adaptive trials leading to even lower response times. It is important for these companies to take a serious look at options beyond just the closed loop clinical supply chain.

Agile clinical enterprise

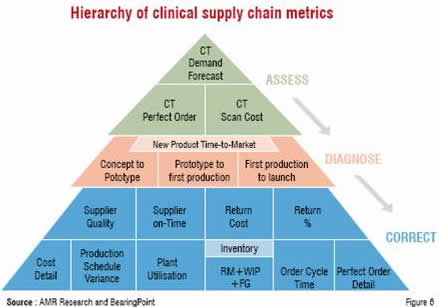

For those companies that run large complex clinical programmes, a robust and Agile Clinical Enterprise (ACE) is a potential solution. Tracking key metrics (Figure 6) to make prioritised, continuous improvement enhances the ability to sense and respond to demand and supply situations through the supply chain, while optimising the key resources.

As can be seen from the hierarchy diagram, there are several key factors both upstream (e.g. Clinical Trial Demand Forecast) and downstream (e.g. Inventory) in the process that finally contribute to the performance, such as the time from concept to launch of a new product. This is not just within the clinical supply chain, but also within the R&D function as a whole. The other components of ACE are described below.

Demand forecast accuracy

There are attempts to focus on what-if simulation using Monte Carlo-type techniques to predict patient retention rates (kit demand) and communicate it real-time to downstream functions. Using the Bill of Material (BOM) explosion, companies are attempting to improve the forecast accuracy of all items critical to ensure on-time availability of clinical supplies. For example, knowing the demands of a “comparator drug” accurately and well ahead of time can save the last-minute rush by sourcing teams and help mitigate risks due to availability of key supplies critical for the success of trials. This can also help drive understanding of the requirements of labels and accessories well ahead of time to give supply chain professionals the ability to determine important make or buy decisions that factors capacity and resource constraints, while ensuring timely availability of these supplies.

Clinical supply chain strategy

Some of the key proven concepts from Consumer Products, Hi-Tech and Automotive can help streamline the clinical supply chain process:

First on the list would be a consumer or patient-centric CTSC strategy. This is a paradigm shift from the traditional concept of “inventory overages” and “build to stock” to ensure high serviceability of continuously changing clinical trial needs. Not only does this help save precious resource capacity in the supply chain, but it helps maintain just adequate inventory, which will minimise the challenges in storage, packaging, labelling, distribution and accountability.

The second concept would be “selective outsourcing” of some of the repetitive tasks or high volume items that do not add much value in the process through internal manufacturing. Some of the potential candidates for this could be sourcing of APIs (with a consolidating and maturing pool of suppliers) or labels.

Third would be the concept of “pooled supplies,” “on-demand labelling” or “delivery postponement,” which is quite similar in objective to the famous Just-In-Time concepts that helped the automotive and high-tech manufacturers remain competitive and profitable.

Global trade management

Taking into consideration that globalisation of trials (demand) and sourcing (supplies) is the future of the industry, it is extremely important for R&D organisations to have a Global Trade Management (GTM) programme in place that can help mitigate the compliance risks and also save millions in taxes and duties. A typical trade management programme would include customs environment optimisation, GTM operations support, GTM data management and performance visibility, trade security and risk management, and a comprehensive global trade governance framework that supports corporate risk and escalation management.

Leverage commercial infrastructure

Mergers, acquisitions and outsourcing are driving companies to consolidate their capacities, including the R&D space. Concepts such as co-development and Quality by Design (QbD) to address scale-up issues are changing the way traditionally technology transfers have been handled. R&D organisations have been asked to consolidate the demand in clinical supplies and use some of the commercial infrastructure in core manufacturing, as well as lab capacities.

Supplier consolidation is another area where R&D can leverage a smaller set of approved suppliers for commercial manufacturing to make it manageable and help lower procurement costs. Making best use of the well-oiled distribution networks by experienced supply chain professionals is one of the optimal ways to mitigate the challenges arising from the highly complex demand and supply networks described earlier.

With a combination of training, formalisation of processes, innovation and smart strategies, companies have tasted success in overcoming the mental block of “we are different, since we operate in a regulated environment.” By overcoming this challenge, companies are able to take advantage of this huge internal asset for driving improvements. One of the ancillary benefits of this approach has been the ability to provide a collaborative virtual organisation for R&D to support key functions, such as global trade logistics, global trade compliance, and key finance functions for budgeting, which were not available early on, due to the perceived cost and value benefits of having a dedicated organisation for R&D.

Supply chain risk assessment

Gathering continuous data on the key supply chain parameters—demand visibility, demand variability, transportation lead times, lead times for internal and external processes like sourcing, documentation, workflow approvals, cold chain supply chain, etc.—to sense and proactively take corrective action not only mitigates the risks but also helps save significant amount spent on taxes, duties and transportation costs. Some of the large pharmaceutical companies have achieved tremendous success in having the global logistics compliance team provide direct oversight and advice to the clinical supply chain experts. By closely tracking the cross-border shipment times, these companies have started planning the shipments from the less busy and more actively supportive ports, leading to significant reduction in lead times and costs.

Similarly, data has been gathered on the maturity and consistency level of vendors, such as contract manufacturers, freight forwarders, customs brokers and clearing agents. This supports the clinical supply chain to take proactive measures in providing training and direct documentation support to mitigate the risks, such as delays or hold-ups in customs clearing due to incomplete documentation or movement of banned substances in those countries.

Armed in advance with the information of the total demand of movement of clinical supplies, logistics compliance teams have been able to work with the agencies of different governments to adequately classify goods. This includes addressing questions on the intended use of the clinical supplies, or even going to the extent of advising the S&OP teams to make intelligent decisions in trial design around, for example, the selection of sites and countries upfront in the clinical trial process. This has helped companies avoid situations where clinical trials have been seriously affected, due to lack of knowledge about the local regulations (e.g. import / export of investigational drug or devices, depot requirements, bio-terrorism laws) in countries like Brazil, Russia, India, China and Japan. Vaccine manufacturing companies have been the hardest hit due to lack of poor infrastructure in some of the developing countries to support cold chain supply chain needs in shipping the clinical supplies across tropical locations.

Automation

Technology is an enabler to automate some of the complex processes described above. This is critical not only to provide single version of truth, scalability and savings in costs, but also to enable a healthy work environment, providing much needed relief to the highly stressed supply chain specialists who are working to ensure on-time delivery of supplies to sites.

Emerging new technology vendors helped in addressing the key needs of clinical supply chain, while the existing Manufacturing Enterprise Systems (MES) and Enterprise Resource Planning (ERP) vendors have recognised the need to provide enhanced solutions to address the specific demands of R&D in the life sciences industry. Leaders in the life sciences industry have recognised this by initiating technology implementation projects, breaking the myth of whether new product development—especially clinical trials with hosts of uncertainties from product definition to demand—can ever be supported by these packaged solutions available in the market. One of the major benefits from technology has been seen in the area of automating labelling as a collaborative process from design, approval to print. Companies have initiated “eLabelling” projects that not only address the complex needs of clinical labelling, but also build a common repository and smooth transition to commercial labelling in a global environment.

Last but not least, with the emergence of Service Oriented Architecture (SOA) supported by most of the solutions listed above, key challenges and risks in systems integration, both internally across geographical locations or with external vendors like contract manufacturers, third-party packaging, labelling and distribution vendors or CROs across time zones and diverse locations, would be addressed.

Training

None of the above can be realised if the clinical supply teams are not provided with adequate and continuous training around key technologies, modern supply chain concepts, global regulations and infrastructure constraints in developing countries and also in different cultures. This is an area where companies in the life sciences industry can improve by investing in training programmes. A combination of internal and external trainings can result in much higher return on investment, which is extremely critical to develop the CTSC into an agile and mature organisation responding to the dynamically changing environment in the clinical space.

Unleash the potential

To all those leaders and practitioners in the R&D organisations within the life sciences industry, in companies both small and large across the globe: it is time for you to recognise that you have an “ACE” up your sleeve and to take the first step towards a closed-loop clinical supply chain to meet the growing complex needs of this industry in a highly competitive environment. It is time to unleash the potential you have in making a drastic reduction to the ever rising lead time and costs of launching a new product in the market. This will not only revitalise the industry as a whole by facilitating the launch of more research projects that can deliver more therapeutic solutions, but also help keep the costs of healthcare—which is having a domino effect on other industries—under control.

References

1. Unless stated otherwise, all data referenced throughout this report is from “Assessing the Clinical Trials Supply Chain Opportunity in Pharma and Biotech,” AMR Research, November 2007;

2. BearingPoint Whitepaper titled, “Clinical Trial Supply Chain Benchmark: Identifying key metrics of the clinical trial supply chain to accelerate time to market and improve efficiency”

3. AMR alert titled “AMR_Research_ARTICLE_20350-Challenges_in_the_Clinical_Trial_Supply_Chain: What is the Rx for success?” Dated April 18th, 2007, by Hussain Mooraj and Colin Masson.