Wearable sensors have the potential to dramatically reduce the duration and cost of clinical trials by enabling objective, real-time, real-world data to be used as health outcomes measures. While most efforts to improve clinical trials have focused on making the existing processes more efficient, wearables represent a real game changer.

Pharmaceutical development is in crisis. According to the Tufts Center for the Study of Drug Development, it now costs US$2.6 billion to bring a drug to market, which is a 145 per cent increase in 10 years. While some question Tufts’ methodology, there is no question that costs are exploding. There are many reasons for this dramatic increase, but part of it stems from the changing nature of healthcare. With ageing populations around the world, and the success in treating infectious and other acute diseases, chronic disease management has come to dominate healthcare. In fact, one study indicated that 84 per cent of healthcare spending in the US was on adults with chronic conditions in 2006 and that number will continue to go up.

In this context, many of the reliable old measures (such as five-year survival rates) are now irrelevant. Today, many studies end up relying on subjective measures, such as doctors asking patients how they are feeling or how much pain they are in, to gauge quality of life. Not only is this highly subjective, but patients will just answer based on their experiences during the past one to two days. As a result, these measures are unreliable and uncertain.

To get more reliable data, clinical trials need larger sample sizes, which drive higher costs and longer trials. And, often that is not enough. Most pharmaceutical companies have stories of a drug that looked great in Phase 2 trials, only to fail in Phase 3.

Adding to pharma’s woes is a crowded market where cost containment has emerged the driving factor. Just about every condition has an existing treatment, and many of them are quite good. As a result, the incremental increased value from new treatments is getting smaller. Profits are getting squeezed. Deloitte conducted a study last year that estimated the return on pharma R&D at 1.9 per cent. That’s less than a U.S. Treasury bond. No company will continue to invest for long at those rates of return.

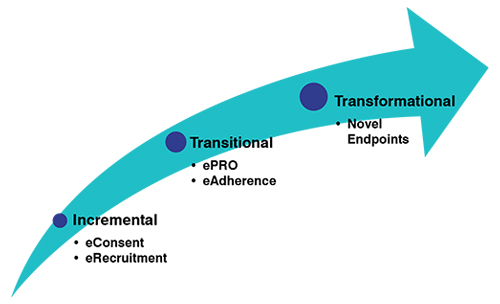

Clinical trials need to be transformed. There are many efforts being conducted along these lines, but this article will focus on the impact of digital/mobile technologies. Some of the tools focusing on eConsent and eRecruitment are incremental improvements. They make the existing process more efficient, but they do not change the nature of the trials. Transitional tools, like electronic patient-reported outcomes (ePRO), and medication adherence solutions, start to adjust the content of the trial and can have significant impact. But outcome measures need to change to truly transform clinical trials.

Novel endpoints change the definition of success for a clinical trial, fundamentally altering the process. Instead of looking at patient-reported outcomes, or the results of tests done every few months in a doctor’s office, putting sensors on the patient allows his or her progress to be documented continuously. For example, an activity monitor on a patient with Parkinson’s disease or Chronic Obstructive Pulmonary Disease (COPD) can determine quantitatively if their activity level is increasing or decreasing over time. It can even provide detailed gait metrics and analysis of freezing episodes. This activity can be monitored 24 hours a day, seven days a week. In doing so, infrequent and often subjective outcomes are replaced by continuous objective metrics that dramatically improve the reliability of the trial.

Continuous objective measurements dramatically reduce measurement uncertainty. Increased reliability reduces the chances of getting an incorrect assessment from the trial. Therefore, they can be used to reduce sample sizes or potentially shorten the trial. In addition, by monitoring patients continuously, it is possible to detect unexpected deterioration in their overall health, identifying potential adverse events earlier and increasing patient safety.

Finally, it may be possible to use the output of the monitoring device to adjust drug doses in some cases. For example, many patients with Parkinson’s disease experience involuntary movements as a side effect of Levodopa medication. One of our customers has a product that distinguishes between Levodopa-induced tremors and Parkinson’s disease tremors. This information is used to adjust the drug dosage, improving the performance of Levodopa. This type of assessment may be possible in many other cases.

But what do global regulatory bodies, such as the U.S. Food and Drug Administration (FDA), think about the use of digital and mobile technologies? They are very supportive. In fact, leveraging real-world data is a key strategic priority for the FDA.

With all these benefits and the support of regulatory agencies, wearables should be adopted rapidly. At some level they are. Based on an analysis of Clinicaltrials.gov data, Shimmer estimates that the number of trials using wearables has more than doubled in less than two years. Unfortunately, it was starting from a really low base — under one per cent of trials using wearables — and doubling got the penetration to just over one per cent.

What’s Delaying Adoption?

Even measuring something as simple as weight can require some thought. How many results should you average? What are the thresholds to determine success? Measuring something as complex as continuous activity or sleep really requires industry standards.

A second barrier is the use of proprietary, non-transparent algorithms. For example, is Fitbit’s definition of sleep the same as Apple’s? What exactly are ‘steps’? What are the error levels? If there was a questionable result, how could the source of the error be identified? If a participant has 3,000 steps in an hour, were they really active or did they just put their device on the dog?

Addressing these issues requires access to the raw data. Raw data, such as those from acceleration, are consistent across manufacturers. Raw data also allow analysts to recalculate results as algorithms improve. A database of raw data can grow and be useful over time. If a bug creeps into the calculation, it can be identified and fixed. Virtually all of the research conducted in academia is based on raw data, allowing sponsors to leverage literally tens of thousands of researcher years of effort. Furthermore, Artificial Intelligence (AI) and big data techniques will almost always work better with raw data. In short, choosing wearables that provide raw data is critical to long-term success.

Then, there are the devices themselves. Many of the wearable devices represent a significant burden for participants. Even the best consumer wearables require frequent recharging. Many of the more scientific wearables are clunky. In addition, sites can be required to provide a huge amount of support, which they may not be well equipped to do.

If the wearable isn’t really simple to use, compliance will fall and sponsors can be left with huge gaps in the data. That creates additional risk and cost for the trial — something no sponsor wants.

But there is hope. For example, in the U.S., the Clinical Trials Transformation Initiative (CTTI), which is a public-private partnership established to develop and drive adoption of practices that will increase the quality and efficiency of clinical trials, has some recommendations.

As novel endpoints are among the more challenging techniques to adopt, CTTI chose them as one of its first areas to address. The organisation has compiled a selection of tools to help pharma and clinical research organisations (CROs) to move more quickly down that path.

These tools provide a roadmap for qualifying novel endpoints. Shimmer has also identified several success factors for moving forward.

There is no question that the science required to make wearable data useful can be challenging. Fortunately, many smart people have been working on answers for years. Shimmer sensors alone have been used at more than 1,000 leading institutions for more than 10 years. Much of this research is publicly available — thousands of these results have been reported at dozens of conferences each year for more than a decade.

Of course, academic work generally does not result in a product. But the basic science has often been done. All that is left is the engineering. And the original researchers are often able and eager to help to adapt their work for clinical trials.

Many industries use remotely deployed sensors, and there is a lot to be learned from them. For example, Innerscope Research, Inc. developed a consumer neuroscience kiosk that enabled medical-grade electrocardiography (ECG), galvanic skin response (GSR), eye tracking, and facial action coding results to be obtained very efficiently from study participants viewing advertising materials in malls and movie theatres around the country. Researchers could download content and recruiting specifications on a Thursday night and by Friday morning be recruiting and running tests. They could get participants set up, expose them to 8-10 minutes of content, ask them some survey questions, and complete the whole study in about 20 minutes.The data would be automatically uploaded and available immediately. They routinely collected data on 250 participants and could have easily scaled up to 2,000 participants in a weekend. That team collected data from more than 100,000 people. The total average cost per participant was less than US$50.

What can we learn from this? Every part of the process was integrated, from recruitment to content selection, to data upload. The custom content was selected in real-time based on the demographics of the individual recruited. The entire project was managed in real-time. The researchers could see at a glance what data were being collected. If certain sites were having trouble recruiting their quotas, their quota could be moved to another site.

Perhaps the most important lesson is collaboration. Innerscope did not build this system alone; it partnered with Shimmer and eWorks and leveraged their technologies and capabilities. As a result, the whole system was built and operational in less than a year.

Collaboration is critical, but the reality is that pharma needs to take a leadership role. It is a matter of simple economics. Let’s consider the potential value generated by the introduction of wearables. Tufts estimated the cost of bringing a single drug to market at US$2.6 billion. We estimate the entire market for wearables in clinical trials at less than half that —US$1 billion per year. A 20 per cent saving in the cost of bringing a single drug to market is likely larger than the entire profit generated by all wearables companies in this market in a year.

First of all, pharma needs to collaborate with a variety of partners to define new endpoints. No company is going to gain a competitive advantage from proprietary endpoints. Everyone — pharma, regulators, healthcare systems, and patients — will benefit if the industry agrees on standards. An important step in this collaborative development has been initiated in Europe with the €50 million Mobilise-D project to define appropriate endpoints for motion-based sensors.

Second, pharma needs to fund exploratory research as part of its ongoing clinical trials to help support the development of endpoints. The incremental cost would be relatively modest, but there is no way that wearables companies can economically do this on their own.

Finally, pharma needs to allow access to data to enable the development of algorithms and endpoints. Although intellectual property is the lifeblood of pharma, this area is pre-competitive. We believe that data generated in a trial should belong to the sponsor. But, fortunately, when asked most sponsors grant access to that information so that we can develop our algorithms. We encourage sponsors to continue to expand that approach.

Of course, the responsibility for progress doesn’t all fall on pharma. Wearables companies need to do their share. In fact, we recommend that sponsors consider several key attributes when looking for a wearables partner.

First, the wearable needs to provide raw data. Using wearables without getting the raw data leads to a dead end. Raw data are required to leverage academic work, understand anomalies, and develop a database that can be used going forward.

Second, wearables companies must be willing to collaborate and be transparent with their algorithms. Not only do researchers need access to raw data, but they also need to know how it is processed, so they can share that knowledge across the industry. It may be difficult for some wearables companies to accept, but the industry needs to find other ways in which to compete.

And last, a wearable sensors platform should be optimised for clinical trials. Participants need to be able to put on the sensor and not touch it for an extended period (months, not days) — no recharging, no data uploads, or anything else required. Ideally, participants would never need to take it off, even when showering or bathing. Raw data need to be uploaded automatically to a completely integrated system with a dashboard that allows the CRO to track what is happening by site and drill down to an individual device if a problem arises.

There have been several themes throughout this article, but the most important one is the need for collaboration. The opportunity to improve clinical trials is huge and we will be able to achieve it much faster if we work together.

References:

1 https://www.ctti-clinicaltrials.org/files/interactive-selection-tool.xlsx

2 https://www.ctti-clinicaltrials.org/files/novelendpoints-flowchart.pdf

3 https://www.ctti-clinicaltrials.org/files/detailedsteps.pdf

4 https://www.ctti-clinicaltrials.org/files/quickreference-fda-contact.pdf