In a changing market for clinical trials where fast recruitment of large patient numbers is of the essence, Site Management Organisations (SMOs) operating as independent Contract Research Oorganisation (CRO) divisions offer some significant advantages in the Asian market.

Site Management Organisations (SMOs) frequently act as both partners and competitors in the conduct of clinical trials for Contract Research Organisations (CROs) and claim to show advantages over them to pharmaceutical companies. Most effective is the integration of study site management in the classical CRO clinical services as it eases the communication between organisation and all parties involved in a trial.

During the last two decades, Asia has become home to the world’s fastest emerging economies and the most challenging market in the world. It is crucial for CROs in important emerging markets, such as Asia Pacific and Eastern Europe, to determine the current market landscape regarding the use of each service; understand customers’ needs and wants; understand perceptions regarding the CRO’s service capabilities versus other service providers (for example management consulting firms); and obtain reactions to each service concept, including likes and dislikes.

Sponsors are increasingly trying to find the most cost-effective strategic solution on which activities to outsource and which type of CRO (full-service, niche-service, regional) to contract with. Consistent service delivery is key strategic objective to enable CROs to deliver superior service in developing countries.

Pharmaceutical companies are increasingly outsourcing to the CROs’ wider spectrum of tasks in emerging markets. Apart from traditional contract clinical services (e.g. monitoring, data management etc) the following offerings are in big demand outside of established pharmaceutical markets: early-stage drug development, medical consulting, laboratory selection, harmacovigilance, staffing, management of opinion leaders’ network, collaboration with external partners, supporting of sales initiatives, educational Internet sessions etc.

The pharmaceutical industry in emerging markets of the Asia Pacific region and Eastern Europe has developed rapidly over the past 10 years. Clinical trials used to be conducted by out-patient departments and specialists within large municipal and university hospitals and were fitted around day-to-day clinical responsibilities. Challenges from different local regulatory systems and cultures are becoming a crucial issue which is increasing the costs of clinical trials. Knowledge of local requirements is vital to avoiding delays.

Independent market research conducted to help in designing and implementing the appropriate recruitment and retention strategy, awareness campaign, appreciation of local ethical, cultural and regulatory requirements, patient referral mapping and site logistics has also shown that international regulatory demands have grown. Consequently, the time needed to conduct high-quality trials has increased, resulting in some investigators becoming less willing or able to concentrate on clinical trials.

At the same time, the pharmaceutical industry has come under increasing pressure to reduce drug development cycle times and to achieve cost efficiencies throughout the process. With clinical trials contributing a significant proportion of drug development time and patient recruitment being a key factor in trial delays, a new way of identifying and managing clinical-trial investigators has been needed. To address this need, site management organisations have evolved as organisations dedicated to conducting clinical trials using specialist physicians and nurses.

Getting the right services into the right markets is the obvious mainstream of modern clinical research industry. SMOs that work as independent CRO divisions are most suitable for the Asian market. They usually work when district physicians or hospital doctors act as investigators. Study visits are controlled largely by the patient’s own doctor, supported by research / practice nurses. Such SMOs would have a regional coordination structure and be responsible for site training and support. Patients are recruited through database searches and during visits to their physicians, making the model suitable for recruiting a large pool of subjects.

The potential benefits of an SMO are well known: rapid and reliable patient recruitment, improved data quality and consistency, reduced study timelines primarily due to quicker study start-up, more accurate doctor contact information, reduced site management time, improved relationships with investigators.

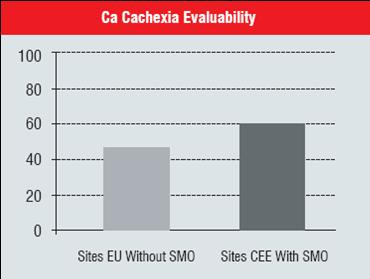

The following pictures show the advantages of conducting clinical trials with site management support in 12 CEE sites in comparison to approximately 50 Western European sites. The CEE sites brought pretty late in the study and with site management support brought to rapid recruitment of Cancer cachexia patients. Additionally the second picture shows that quality of the trial has not been compromised with such a fast recruitment, but in fact the patients’ eligibility was higher in CEE sites. The reason for it is certainly better patients’ selection as well as higher retention of these terminally ill patients in the study.

Unfortunately, many sponsors are still unwilling to pay more or even reschedule the timing of their study budget in order to reap the potential benefits of working with an SMO.

An SMO derives income primarily from clinical trial fees, usually related to completion of a specific patient visit. In this way, the balance between income and costs can be delicate with too few studies or slow recruitment causing a dip in income. For this reason, SMOs must focus on highly efficient patient recruitment systems in order to obtain new studies and on quality systems to deliver the best possible data. Both these deliverables are expensive, but they can distinguish an SMO from an ordinary clinic-based investigator. To benefit, sponsors need to realise that they have to increase their study budgets so as to work successfully with SMOs—sponsors cannot demand rapid recruitment and high quality without paying for it.

In a decade where there has been no significant decrease in time-to-market, but an increase in the average number of patients-per-license application, SMOs offer sponsors a lifeline for enhanced patient recruitment. They can pledge improved recruitment rates and attainment of aggressive milestone timelines. Their success is dependent on first hand knowledge of patient populations and well defined relationships with broad investigator networks. Where they are able to deliver, they obviously add value, and importantly for a sponsor this value is added to a different line of the cash flow analysis to that of a CRO.

CROs and pharma companies often struggle to ensure the quality or accuracy of protocol feasibility because they work infrequently with their investigator sites and have limited knowledge of the

local clinical and logistical arrangements. Similarly, they are rarely able to access hospital data to verify the recruitment claims of potential investigators. Because SMOs work closely with sites that they manage and support, they should have an intimate knowledge of the strengths and weaknesses of the clinical trial process within each site and be well placed to make thorough assessments of their suitability for a particular study. While feasibility assessment is a key tool for accurate project placement, these exercises can also offer sponsors the opportunity to develop relationships with

opinion-leading specialists in key markets.

Because an SMO works regularly with the same group of investigators, there should be clear benefits in terms of both data quality and consistency. SMOs have their own standard operating procedures and may put their investigators through a common, generic training programme as well as providing study-specific training. Effectively, the SMO provides an umbrella over its network of investigators reducing the administrative or management support that a sponsor would otherwise need to

provide individually to each site.

SMO capability in the Asian market is limited to a few small companies. Site Management Organisations operating as independent CRO divisions offer some significant advantages in the Asian market.

Expanding geographic coverage with a view to contributing more investigators and more patients to an international study is the way of doing this.