Digital technology is transforming the life sciences sector: from Artificial Intelligence (AI) mining compound libraries for drug discovery, and software and electroceuticals as therapeutic solutions, to sensors in chips monitoring adherence and absorption, this disruption will only accelerate.

While the life sciences sector has incrementally adopted digital technologies over the years, the rate of digital transformation over the next five years looks to be unprecedented. Collaborations and acquisitions in the pursuit of digital transformation have accelerated significantly. In 2018, US$9.5 billion was invested in the digital health sector over 698 deals. From the FDA approval of Otsuka’s sensor embedded drug Abilify Mycite and the approval of Pear Therapeutics’ app for the treatment of opioid abuse, through to Takeda’s partnership with Emulate Inc for the use of organs on chips for drug discovery and development, every aspect of the pharmaceutical sector is ripe for digital disruption

Areas of particular interest for transformation include: (i) the drug discovery and development phase; (ii) interactions with healthcare professionals and patients; and (iii) complementary or standalone therapeutic software treatments.

Traditional methods of drug discovery and development are expected to last ten years and cost more than US$2 billion. However, the use of AI, organs on chips, apps and wearables could significantly reduce these timescales and costs.

AI is already being deployed by a number of pharmaceutical companies for a whole range of purposes, including drug discovery. The ability to mine huge volumes of public data, as well as significant private data sets (e.g., compound libraries and clinical trial data), represents an unprecedented opportunity to identify potential targets, drug candidates or even new indications for existing drugs, faster and more costeffectively. These newly identified targets or candidates can then be developed and tested, with the data this generates being processed by the AI algorithm to further refine its learning. Pharmaceutical companies including Astellas, Mitsubishi Tanabe Pharma, Santen, Takeda, and Sumitomo Dainippon Pharma have all announced various collaborations with AI businesses for drug discovery and development. The success stories for using AI are compelling: the Barrow Neurological Institute successfully used IBM Watson to analyse all RNA-binding proteins in the human genome, genomic data and published materials, and identified an additional five amyotrophic lateral sclerosis RNA-binding proteins which were previously unlinked to amyotrophic lateral sclerosis.

While the development of organs-onchips is nascent, if successful, they offer an entirely new approach to clinical trials. California-based company, Emulate Inc, has developed a liver chip, lung chip and intestine chip and is currently performing studies with the FDA to assess the use of organs-on-chips for toxicology studies. The possibility of replacing animal trials, and even human trials in due course, with organs on chips could transform the drug development process. Likewise, the use of AI to mine patient data to identify optimal trial subjects as well as trial subject ‘matching’ apps (where interested trial subjects can be matched to potential trials and apply via an app), look set to materially alter the trial recruitment process. The use of apps, wearables and remote devices in trials offers the potential for continuous monitoring of, and increased interaction with, trial subjects with limited interference in the trial subjects day-to-day life, which may improve trial recruitment and retention, as well as the quality of data generated.

Digitalisation also allows for pharmaceutical companies to interact with Healthcare Professionals (HCPs) and patients in new ways. This might include electronic ‘pop up’ reminders for HCPs, new ways of imparting information to patients, or complementary apps to support patients receiving certain therapeutic treatments. Digital transformation could disrupt drug detailing which has not seen significant change in approach for many years. Indeed this digital approach reflects a new generation of HCPs with limited time for detailing meetings and, in some cases, decreasing interest in facetoface interactions with the sales force. At the same time, this type of continual remote patient-support offers a new way to develop patient-centric care, while also potentially reducing the need for acute care intervention (e.g., by offering remote monitoring or support, or improving medication adherence) which will improve the patient’s quality of life as well as reducing costs for healthcare systems.

In addition to transforming how drug products are developed and administered, digital health has the potential to see traditional drug products replaced with therapeutic software solutions. While historically these types of digital solutions have been focussed on wellness with diet apps, fitness wearables and relaxation apps, or helping patients to manage chronic conditions with symptom journals and trackers, this is now shifting towards true therapeutic solutions. Examples include Pear Therapeutics’ app for the treatment of opioid abuse and virtual reality with bio-data-driven applications to treat acute and chronic pain. Of particular interest is the treatment of mental health diseases, with software platforms offering AI-driven triage facilities, coupled with treatment techniques and access to human physicians interacting via messaging or telephone, at any time.

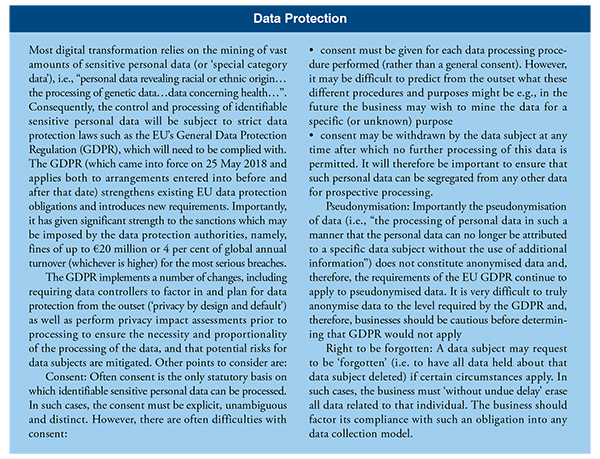

A recent study performed by the international law firm, Simmons & Simmons LLP, asked more than 400 international c-suite executives across the life sciences and technology sector about the opportunities and challenges presented by digital health. Notably 71 per cent of all respondents stated that digital health will transform patient care, with 63 per cent putting digital transformation at the top of its agenda. While the US has long been the digital health front runner, the study shows that Asia-Pacific could soon catch up. Respondents in Asia-Pacific were most likely to say digital health was a strategic priority and that they would be investing more in digital health over the next three years. However, only 11 per cent of all digital health opportunities that come to an organisations’ attention enter detailed due diligence and just a third of those are executed. Life sciences respondents indicated that half of their digital health collaborations in the past three years did not meet their stated objectives. Perhaps unsurprisingly, respondents indicated that two of the main challenges for digital transformation projects result from data protection and life sciences regulation.

In addition to ensuring data privacy, businesses will need to ensure that their new ways of interacting with HCPs and patients, as well as new products, comply with applicable life sciences regulations.

For example, in the EU (and the UK) promotion of prescription-only medicines to the public is prohibited and, therefore, businesses will need to ensure that any complementary apps supporting patients do not promote the related (or any other) prescription-only medicine. Equally, consideration should be given to whether any automated interaction with HCPs constitutes promotion such that it will need to comply with applicable advertising laws or interferes with any post-market pharmacovigilance obligations.

Under the EU Medical Device Regulation 2017/745, software which has a medical purpose may qualify, and be regulated as, medical devices in their own right (sometimes referred to as ‘software as a medical device’ or ‘SaMD’). Businesses will, therefore, need to carefully consider the purpose and functionality of software it develops as well as the claims made about it, in order to determine whether or not it would qualify as a medical device. If so, then consideration should be given to the classification of the device. Previously, in the EU, most SaMD was classified as a Class I device which is subject to a relatively straight-forward market access pathway involving self-certification of the device’s compliance. However, increasingly SaMD is being accorded a higher classification which requires a more involved market access pathway including assessment by a regulated third party (‘notified body’). For example, apps focussed on the treatment of acute mental health conditions to prevent suicide, could have very serious effects if defective and therefore may be subject to a higher classification. Businesses should also be mindful about how classification might change with revised iterations of the software. If a software solution does qualify as a medical device, then, not only would the business need to comply with market access requirements, but also extensive post-market obligations regarding traceability, supply chain management/visibility, adverse event monitoring and reporting and advertising.

With a 32 per cent increase in investment in digital health in 2018 compared to 2017, digital health looks likely to go from strength to strength. However, in many cases these developments can only be achieved through collaboration between pharma businesses and new and incumbent tech businesses. In doing so, pharma will need to navigate a myriad of legal and cultural issues in order to realise its digital transformation including IP ownership, regulatory compliance, product liability, data protection and cyber security issues.