In life sciences, traditional supply chains were designed from the inside-out perspective. To adaptively meet actual demand from the customer and translate it into global trade-offs, supply chains need to be designed from an outside-in perspective.

The global pharmaceutical market has never been more competitive, and therefore, companies are searching for sources of sustainable value. Consider the increased competition created by a flood of “me-too” drugs, combined with ever-decreasing rates of pipeline productivity and the need for the significant changes to healthcare delivery models. As margins continue to shrink, both investors and patients are demanding that more efficacious products are delivered to market faster than ever before. These changes in the market have helped pharmaceutical companies realise the value of their supply chain.

Recent supply chain operations’ discussions with a number of large pharmaceutical companies clearly indicate what separates the leaders from the rest of the pack. Taking cue from consumer products and high-tech companies, pharmaceutical leaders are beginning to think of their supply chains as strategic weapons! The rest of the pack still struggles to consider their supply chain as anything more than a procurement or logistics function. Leaders are driving the transformation from the top-down, eliminating any cultural or organisational impediments to change. However, as one supply chain executive from a large global pharmaceutical company noted, the issue before the rest of the pack is that they have to convince their businesses that they can’t win without superior supply chain capabilities.

What is demand-driven manufacturing?

In life sciences, traditional supply chains were designed and operated with inside-out thinking. All supply chain and operations processes—from planning, sourcing, manufacturing, and distribution—were designed without considering the needs of upstream and downstream trading partners, let alone the patient. This inside-out, and in many cases, one-size-fits-all approach to supply chain design sub-optimised the company’s total product supply capability.

In today’s environment, leaders are designing their supply chains from an outside-in perspective to adaptively translate actual demand from the customer into trade-offs that profitably fulfill perfect orders. The goal is to create opportunity at the lowest cost and maximise value to both trading partners and the end customer (i.e. the patient). Supply chain teams at leading companies are focussed on the synchronisation of demand and designing the most profitable response, which means focussing holistically on each interaction across the value chain. This is a significant shift from existing thinking. Driving this point of view within the business and inspiring the traditional life sciences supply chain organisation is a major challenge. Again, this wave of change needs to be led from the top-down in order to be successful.

Design your supply chains to win

Supply chains need to be designed for profitability, not inherited and operated as non-value adding cost centres. In the early stage of supply chain, most companies identify their supply chains by product families or physical product flows. Leading companies identify their supply chains by a variety of characteristics, including demand and supply variability, volume, technological complexity, asset constraints, marketing channels or stage of product life cycle. These companies then design their supply chain response capabilities to provide the optimal balance of supply chain efficiency and agility. The result is a fundamental shift on the part of leading life sciences companies towards aligning supply chain strategy with both enterprise-level business strategy and operational-level procedures.

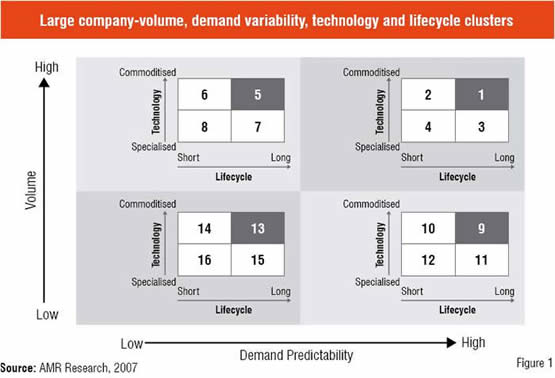

So, an interesting question to be asked in this context would be “How many supply chains one should really have?” Consider one global company that wanted to migrate from a one-supply-chain-fits-all strategy to a network design based on an understanding of how technology, demand, and product variability translate into operational excellence. To accomplish this task, the company evaluated its product profile of tens of thousands of items using a new framework (see Figure 1).

For each circle, the company developed an operating strategy. Each of the 16 different value networks was redesigned using value-network principles:

• For high-volume products with predictable demand, the focus of the value network was on efficiency.

• For products with highly variable demand and short product lifecycles, the focus was on responsiveness.

• For low-volume products with highly variable demand and short product lifecycles, the focus was on portfolio rationalisation.

The company drove improvements over the last year through flexible manufacturing work centres, postponement strategies, and pooled inventories for products. These networks were continuously tweaked in Sales and Operation Planning (S&OP) processes by aligning demand-shaping and agility levers (See AMR Report How Do I Drive Value Through a Value Network?)

Developing product supply capabilities – A focus on Asia

In a recent survey, AMR Research studied Asian pharmaceutical companies’ efforts to develop demand-driven product supply capabilities. The survey included 50 Asian life sciences manufacturers (i.e. pharmaceutical, biotech and medical device companies). The size of these companies was decided on the basis of their annual revenues. Survey questions related to product supplies were designed to identify the gaps in their current performance. The results of these inquiries revealed the following gaps in their top product supply performance:

• Achieving compliant, right first time manufacturing response to demand

• Driving a balance between compliance and cost, while eliminating waste and inefficiency along the way

• Leveraging third party capabilities to improve new product development, launch processes and to help lower costs

• Driving collaboration across the various functional groups throughout the enterprise

Get started on your transformation – Ask the right questions

Pharmaceutical companies in Asia need to rethink and redesign their supply chain processes to address the performance gaps identified above. The following guiding principles will help lay the foundation for transformational change:

1. Align the organisational structure: Companies must think outside-in from the definition of right first time (or perfect order) all the way back to sources of materials and supplies. This will help align organisational incentives and drive effective team management of transformation processes.

2. Design business processes for compliance and efficiency: Companies must design operational and supply chain processes from the inside-out to ensure quality and compliance, and minimise the time and resources required to deliver products “right first time”.

3. Provide support with Information Technology: Systems, databases, and tools must provide end-to-end value chain visibility and provide a platform for scenario modelling, impact analysis, and broad project collaboration and management.

Building from these guiding principles, specific recommendations for pharmaceutical companies in Asia lie in addressing the following key strategic questions:

• Does your top management see supply chain as a strategic priority?

• How is your company organised? Are incentives aligned across functions to drive the desired behaviour and business outcomes?

• How do you see end-customer (i.e. patient) demand? How long does it take to sense changes to demand?

• Most importantly, what do you do with this demand information? Do you use demand data in global supply chain trade-off decision processes?

• How effective are your global sales and operation planning processes?

• Do you have visibility across your end-to-end supply chain? Can you readily and accurately identify inventory across your supply chain?

• Do you have Joint Value Creation (JVC) strategies in place with both upstream and downstream trading partners? Do these JVC strategies focus on developing long-term, win-win relationships or are they one off, short-term collaborative projects?

• Have you defined a business performance measurement strategy and a set of relevant, interdependent metrics that support your business strategy and influence the right behaviours?

• How are you managing risk and complexity?

• How do you pull all of this together into a supply chain strategy?

There are no “one dose, one tablet” therapies for driving transformational change of your supply chain capabilities. In fact, it is an organisational journey best embarked upon with a spirit of relentless improvement and a hefty dose of change management expertise. Specifically, life sciences companies in Asia must realise that simply implementing a software application or commissioning a low-level, under-resourced project will not successfully transform supply chain capabilities.