A roadmap for Asian vaccine research and development programmes can lead to a strong regional vaccine industry, self-sufficient healthcare policy and the possibility of economic growth through the manufacturing of valuable biological products.

Investigator and Director, Vaccine Research & Development Center, National Health Research Institutes, Taiwan

As Nelson Mandela once wrote, "life or death for a young child too often depends on whether he is born in a country where the vaccines are available or not", this may be regarded as a political description of the current global healthcare problems. Vaccine manufacturing capability has been used as an index to profile whether a country is developed or not. Despite having the economic wealth, Asian governments now recognise that they do not have access to sufficient vaccine supplies, leaving their populations at high risk. The Taiwanese government is self-financing a vaccine manufacturing programme and is looking for international collaborations to have sufficient vaccine supplies in the future.

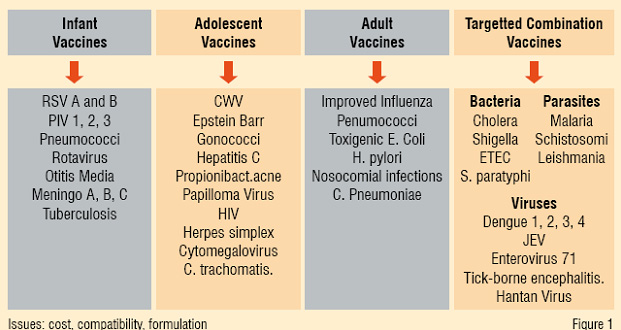

Figure 1: Combine Vaccines for the 21st century

As more shots were given to infants, multivalent combination vaccines were invented and have now become the trend. In addition, most global vaccine companies are now embarking on vaccine R&D to position themselves as the target and portfolio-specific manufacturers as shown in Figure 1.

The current global vaccine market is growing rapidly, having seen double-digit growth for the last 10 years and was worth US$ 10 billion in 2007. Over 95 percent of the current global vaccine supply is controlled by five international vaccine manufacturers: Sanofi Pasteur, GlaxoSmithKline, Merck, Wyeth and Novartis. These companies will continue to dominate vaccine markets since they not only buy up small vaccine R&D companies but are also expanding their manufacturing capacity by building more facilities globally.

In the last 25 years, vaccine branches within big pharmaceutical companies were either closed or sold to other vaccine manufacturers. Specific industrial challenges, such as complexity of the vaccine development and clinical trials; sustained R&D investment from annual revenue; balancing high-risk projects in product portfolio; production cost and yields of immunogens (cost driver); large investments in upgrading and building new manufacturing facilities and potential liability issues (IP, Regulatory and Safety issues) had prevented small and middle-size vaccine companies to compete with big international pharmaceutical companies. Instead, they were vulnerable as targets for acquisitions. In addition, manufacturing technologies require specialists and the entry fee for vaccine manufacturing is also extremely high. For example, building a cGMP vaccine plant for 20 million doses of flu vaccine could cost between US$ 60 to 100 million. The long-term investment and high risk of poor return keep most venture capitalists at bay. Anti-vaccination movement in the past also did not help the vaccine industry to grow. All of the above issues describe well why the vaccine industry did not develop in Asia.

Although the vaccine industry has many issues and hurdles mentioned above, the desire for disease control and eradication, the long-term healthcare cost savings, the prevention of economic loss due to emerging pandemic diseases and the national security reasons against bioterrorism have changed the governments' vaccine supply policies. The increasing middle class population in Asia demands better living quality. Also, the success of anti-cancer immunotherapeutic drugs (monoclonal antibodies), the potential application of vaccine against allergy and autoimmune diseases and the constant market values have totally revitalised the landscape of vaccine industry. However, the issues of intellectual property and the availability of low-cost vaccines are the last hurdles in fulfilling Mandela's dream. Professor R Klausner recently proposed new approaches to solve the global healthcare problems. They are:

As mentioned above, vaccines in the past have been viewed as commodities with low rewards, but Hepatitis B vaccine and anti-cancer immunotherapeutics have changed the whole vaccine market analysis. The initial market price for Hepatitis B vaccine was US$ 200 for three doses. There are 10 new vaccines licensed in the past few years and the vaccine market has grown from less than US$ 600 million in 1985 to US$ 10 billion in 2007.

As new vaccines come up through technologies, what are the new proven manufacturing technologies for vaccine and immunotherapeutics industry? Most old vaccines are attenuated and could be non-pathogenic strains of bacteria (BCG and S. typhi) or viruses (polio, influenza, mump, measles, and rubella). New vaccines like varicella and rotavirus which were introduced in the market have brought about higher profits for companies like Merck. The capsules of the bacteria have been used alone (Meningococcal A, C, Y, W or 23 serotypes of pneumococcal) or conjugated to a carrier protein (Hib, PCV-23 and tetravalent of meningococcal) as vaccines against meningitis and pneumococcal infections. The conjugated vaccines were introduced recently and are very expensive (US$ 300 for three doses).

• Protective Antigen Discovery

• Bioinformatic analysis/ Reversed Genetic Immunisation

• Receptor-Binding Domains Discovery

• Novel CTL Epitopes Discovery and Vaccines

• Biochemical Micro-analysis (Affinity Chromatography/LC/MS/MS)

• Discovery of CTL Epitopes Using MHC-Binding Motifs Predictive Algorithms

• Epitope Discovery using Genomic Sequences

• CTL epitopes based Vaccines

• Plasmid-based Chimeric Reassortant live Vaccines

• Virus-Like Particles (VLP)

• In vitro, Antigen and Adjuvant Screening

• HLA-tetramers or dimers Development

• Transgenic mouse models

• Prime/Boost mixed modality of Immunisations

• Microencapsulation for controlled-release

Currently, there are several subunit vaccines (Acellular pertussis, diphtheria and tetanus toxoid, hepatitis B and HPV). A peptide-based vaccine is currently licensed as an animal vaccine for Foot-Mouth Diseases Virus (FMDV) in China. Although live microbial either lives virus or bacteria have been investigated as vectors for vaccine development, so far none of them is successful. There are many reasons why these novel technologies have not been successful in vaccine development. Risk of oncogenicity and poor immunogenicity in humans are the most important factors that need a lot of research. Edible vaccines have been proposed to be the next wave of human vaccines for the developing countries. However, beside the poor immunogenicity of edible vaccines in humans, the regulatory issues will most likely prevent any edible vaccines from being licensed and used in humans since the stability of edible vaccines will not be longer than two months, and the conditions for growth of plants can hardly be validated.

In the bioprocesses for manufacturing biologics, the processes for producing inactivated bacterial vaccines have not been changed. However, the manufacturing processes for attenuated or inactivated viral vaccines have significantly improved since the introduction of polio vaccines. The cell-culture has now moved from the egg-based to the roller-bottles technology and now to 6000-litre bioreactors with serum-free media that is preferable due to Prion potential contamination. New technologies like "Wave" developed by Wave Biotechnology (US) or "BelloCell" by CESCO Bioengineering Co (Taiwan) provide easy start-up and scale-up disposable cell culture technology. The other method to increase cell growth is by using micro-carrier beads that give cells more growing areas. Increasing cell growth by ten-fold is still possible. To improve virus yield, several technologies have been recently developed. The most promising one is to transfect more viral receptor genes into the host cell, so that the virus infection increases with lower MOI. The other method is to remove the genes inhibiting viral replication within the host cell by gene-lockout. Reverse-Genetic (RG) technology has also been applied to improve virus yield by inserting specific protease cleavage site or temperature-sensitive growth mutants. Serum-free media has given cell culture technology a big boost, but the downstream purification processes are still critical for the whole production cost. Zonal centrifugation with sucrose gradient is the best way to purify virus from the culture media. The additional diafiltration and concentration steps are always helpful. All these improvements in virus production have allowed the traditional influenza vaccine production method to overcome the potential shortage of eggs during the pandemic influenza outbreak by switching to cell-culture-based vaccine production.

Now most big pharmaceutical companies have set out criteria for their R&D projects. The projects are now evaluated in three areas: the statement of interest, project prioritisation ranking and return of investment analysis. The Statement of Interest will show the market needs, global or regional. The product information such as the disease and epidemiology is known; scientific rationale is fully supported by animal model, easy phase III end-point evaluation, cost-effective with optimal profile; favourable in the SWOT analysis; market opportunity and consistent with company portfolio and foresee no potential hurdles. The project ranking for the feasibility and success is high. For the scientific criteria of a vaccine candidate, safety, efficacy and cost effectiveness are the most important factors. The vaccine candidate should have safety profile and easy compliance to cGMP.

Significant advancements in molecular biology, immunology, protein engineering, upstream and downstream bioprocesses engineering and microbiology have brought new tools and concepts to vaccinology and immunotherapeutics development. The most important novel and new emerging technologies for vaccine development are summarised in Figure 2. The first step for vaccine development is identifying the protective antigens. Bioinformatics and reverse vaccinology (DNA immunisation) have increased the potential to identify protective antigens and active pharmaceutical ingredients (API) from genomic sequences of a bacterium or virus. Receptor-binding domain discovery using protein engineering also helps identify authentic receptor and functional domains of either the viral or bacterial surface proteins. In turn this result will validate the protective antigens. By isolating critical and functional cytotoxic T lymphocytes (CTL) using advanced chromatography and mass spectroscopy technology or computing predictive algorithms, the protective antigens can be identified. Now by using fresh human blood the in vitro B-cell immune response screening method can be performed to evaluate the potency of the protective antigens. However, purifying the protective antigens from a natural source or production by recombinant technology is still the best way to validate the potency of the vaccine candidates in animal models (transgenic mouse with human HLA genes or non-human primates).

Not all antigens are immunogenic by themselves. Some of them require adjuvant or special formulations. Again by using fresh human blood, in vitro screening of the potency of the adjuvant candidates can be performed by analysing the cytokine profiles of T-cell immune responses. Since all vaccine candidates can not be evaluated in the Phase I and II clinical trials, transgenic mouse and tetramer technology are used as surrogate markers. Sometimes the adjuvant may not give the right immune responses such as mucosal or specific effectors. Vaccine vectors or carriers are created for these types of immunisation route and schedules. More and more literature has been documented to demonstrate prime/boost mixed modality of immunisation schedules which give the best immune responses in animal model and human clinical trials.

A few years ago, during Phase 1 clinical trials conducted and sponsored by WHO, a single dose of microencapsulated and controlled release tetanus toxoid showed long-term immune responses compared to those obtained from multiple injections of current tetanus toxoid vaccine. Therefore, microencapsulated and controlled release vaccine technology will certainly change the landscape of vaccinology. The other technology that currently has significantly changed the influenza vaccine R&D and annual tri-valent flu vaccine production is the reverse genetics. Using plasmids and reassortant method, the right vaccine strain can be selected and designed for production. In fact, the nonpathogenic avian flu vaccine strains are created by 8 plasmids reassortant technology by WHO reference laboratories.

The production of vaccines and immunotherapeutics are highly regulated and need to comply with cGMP guidelines. Biosafety is highly emphasized in manufacturing vaccines since there are huge potential health hazards involved in the bioprocesses. Therefore, the facilities are normally designed to protect the workers as well as prevent product contamination. The man-flow and material-flow are clearly outlined in each room. With the new guidelines from the Pharmaceutical Inspection Cooperation Scheme (PIC/S), everything involved with or contacted with the products need full validation. Starting from the manufacturing facility design qualification (DQ) to facility installation qualification (IQ), operation qualification (OQ) and performance qualification (PQ) are also required as the part of facility validation. In addition to the facility, Quality Assurance is particularly important and the biologics manufacturing must strictly follow carefully established and validated methods of preparation and procedures (SOP). Therefore, cGMP quality management training and biosafety are very important. The consistency of manufacturing vaccine products is very important. The production processes validation is getting complex and needs a master plan and validation schedule. Some of the new bioprocesses technologies look promising at the R&D level, but are never used in production due to the regulatory and validation issues.

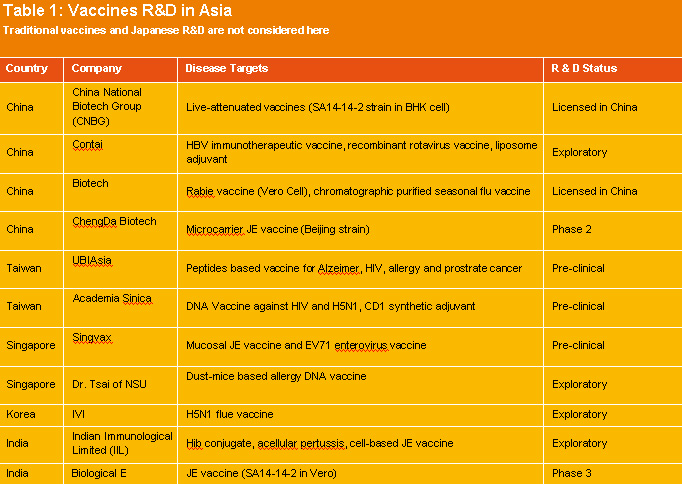

Japan has been very successful and currently leads the Asian vaccine industry. On the other hand without immediate government funding and support, other Asian countries may not be able to compete globally in the near future. Vaccine industries in China, India and elsewhere in Asia are catching up by implementing cGMP quality management, manufacturing and supplying traditional vaccines to their local markets. They do not have enough funding and technologies to truly compete globally in novel vaccine research and development. The vaccine R&D in Asia is still in its infancy. As shown in Table 1, two unique features of vaccine R&D in Asia are identified. Two vaccines needed regionally, enterovirus 71 (EV71) and Japan encephalitis virus (JEV) seem to be the priority targets for vaccine development. High risk vaccine R&D such as vaccines against HIV, dengue, allergy and meningococcal group B, is also being embarked on.

To develop a successful vaccine business in Asia, all parties (Academic, Government funded vaccine R&D centres with cGMP pilot plants and private industries) need to work together with risk/profit sharing in mind. Academic and government funded vaccine centres play the upstream roles: antigens discovery and proof of concept in animal model. Since most small biotechnology companies and academics do not have sufficient budget for Phase I trials, government vaccine centres should collaborate with them, playing the transition roles by using the pilot plants for cGMP-grade clinical materials production, providing cGMP quality management training and initiating Phase I and II clinical trials with Investigational New Drug (IND) dossier submissions. In this way, the government vaccine centres take the risk for conducting the Phase I and II human clinical trials. If the vaccines successfully go through the proof of product in human trials, private Asian vaccine manufacturers can invest to license the vaccines from the government vaccine centres, build manufacturing plants, take the proven vaccine candidates to market by conducting Phase III clinical trials and develop global marketing strategies. As an incentive to local vaccine industry, governments can provide long-term vaccine purchasing contract policies. In this way, all parties (academics, small biotechnology company, government vaccine center and vaccine manufacturers) will be the winners, sharing the profits and securing the national vaccine supply chains.

Certainly if Asian countries can build strong vaccine industry, then the national healthcare industry will be self-sufficient, and the country would be able to think about economic growth through manufacturing valuable biological products.