In a rapidly changing market, the only competitive advantage that lasts is the ability to learn. Here is how our enduring biomedical market leaders do that.

If you have worked in the biomedical industry for more than a couple of years, you will have noticed one of its most characteristic features: change. Pharma, medtech and related businesses operate in a complex environment of two halves: the sociological and the technological. Our sociological environment, including demography, epidemiology and politics is in flux as we master the diseases of youth and enter the battle with the implications of old age and lifestyle. And our technological environment is a storm of ‘omics, systems biology, nanotechnology, and information technology. Business environments tend to exhibit “punctuated equilibrium” in which periods of slow change are interrupted with bursts of rapid transformation. There seems little doubt that our industry is in the midst of just such a spurt of evolution.

Change poses a problem for biomedical companies, especially large ones. Technical complexity, regulation and culture make them slow, ponderous beasts whose proven capacity to improve lives is countered by their inability to respond to rapid market change. Anyone who has attempted significant change in a large biomedical company will recognise this issue. This inertia accounts for the demise of many organisations, as shown by the turnover of names in the “top 50” lists of companies. Yet those lists also pose a question: if the success of many companies is fleeting and ended by market change, what about the others, those that survive for decades or centuries? What is it that those enduring companies do differently from their short-lived rivals?

The question of what causes longevity in a changing market has been investigated by many researchers, who converge onto one simple answer: organisational learning. In short, companies sustain their competitive advantages by drawing new knowledge from what is going on around them and then acting on that insight. But such a simple answer creates another set of questions: how do biomedical companies learn? What is the process by which longlasting companies learn faster and better than other companies? My research has studied this for many years and, in the following paragraphs, I distil it down to a few, actionable lessons.

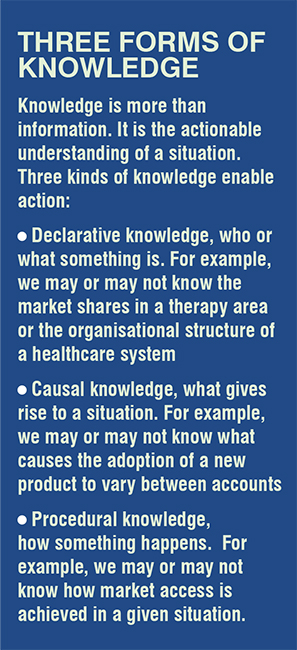

The journey to knowledge begins with agreeing what the firm does not know but needs to. That knowledge comes in three forms (see box 1) and learning begins with defining what kind of knowledge needs to be created. Is it declarative (e.g., What are the primary issues facing a clinical speciality?) or causal (e.g., Why do some patients not adhere to treatment?) or procedural (e.g. How do professionals choose between treatment options?). In practice, many firms collect information habitually but not reflectively, without thinking about what they are trying to learn. But, in my research, the ability to identify and admit to critical knowledge gaps is characteristic of learning organisations. To do so requires two component capabilities, first an analytical facility to spot the gap and second the cultural knack to avoid blaming. Firms in which admitting ignorance is a culturally unacceptable, blameworthy fault are very unlikely to learn or endure in a changing market.

The task of creating knowledge has been usefully compared to cooking. There are many ways to cook a meal and the method you adopt depends on what ingredients you have and what it is you want to prepare. When organisations learn, their “recipe” is shaped by the kind of knowledge they want create and the data and information “ingredients” they have available. That said, there are three main ways — deduction, induction, and abduction — of turning those ingredients into either declarative, causal or procedural knowledge. Although different functions and professions tend to prefer one way of “cooking” information over the other, it is simplistic to judge them as better or worse approaches. Organisational learning is pragmatic, meaning the best approach is the one that works in a given situation.

When market change is clear and measurable, and the goal is to understand that change, then deductive learning is usually the best method. This involves proposing an explanation for the change and developing a hypothesis from that explanation. For example, if the market share of a premium-priced therapy is declining, one obvious explanation is that payers are switching to lower-priced options. This leads to the hypothesis that if price is the explanation, then the shares of lowerpriced equivalents should grow at the expense of high-price products. When the data supports that hypothesis, the putative explanation is upheld and becomes new, causal knowledge about how the market works. If, however, the data shows other patterns, such as shift to an equal-priced rival, then other, non-price explanations are needed and a new cycle of hypothesis testing is needed.

Deductive learning is the most obvious learning method. It is the basis of most scientific methodologies. But it is much less common in biomedical markets than you might expect. In part, this is because it is hard to isolate one variable and control for others. Just as often, however, deductive learning is feasible but managers are happier to have faith in their long-held, subjective beliefs rather than to risk them being proven false.

When market change is messy and hard data is unavailable, and the goal is to unravel what is happening, then inductive learning is the preferred method. Less structured than deductive learning, induction can appear structure-less when, in fact, its process is implicit. For example, prescriber behavioural issues such as adherence to patient pathways can be studied by exploring the experience of multiple prescribers. By structuring that exploration into episodes, such as when adherence persisted or failed, or into crosstherapy comparison matrices within the same group of prescribers, patterns are more likely to emerge. In this example, the research might induce that adherence is inversely proportional to experience and self-confidence, an example of new declarative knowledge. Induction can be a richer, more insightful method than deduction but it is vulnerable to cognitive biases and method design needs to guard against that.

Inductive learning is the most common learning method amongst executives. But because it is pervasive and often implicit it is often not even recognised as a learning method. By recognising when they are inducing new knowledge, managers can make the process explicit, more structured and more effective.

Between deduction, which tests existing thinking, and induction, which draws out new ideas, lies abduction, which works well when multiple views of the world vie for acceptance. For example, why market access decisions vary between countries might be explained by rational, quantitative decision making, by variations between country’s health systems or by irrational decision processes, such as internal politics. In this situation, some facts, including decisions and explicit decision processes, are known but other facts, such as internal dissent and implicit decision mechanisms are not. This uneven mix of information ingredients favours abductive learning, which might be best described as the “best fit” method. In this example, abductive learning would start with halfformed hypotheses such as:

With each hypothesis completed by a description of what facts would fit each explanation.

These tentative hypotheses would then be compared to the findings of structured, inductive methods, such as comparisons of different cases and interviews with decision makers. The hypothesis whose prediction most closely matches the inductive observations is the most likely to be true. In this example, our research found that market access is “boundedly rational”, that is it was rational within the specific context of the country. This combination of two explanations was new insight into how market access decisions are made and is an example of procedural knowledge.

Abductive learning is, in many market situations, the most powerful learning method, yielding actionable insight into important and messy situations. But it is also the method that requires most skill. Deduction requires a systematic approach and induction demands a degree of intuition and sensitivity to the data. Abduction requires a systematic approach, sensitive intuition and the ability to allow rival explanations to compete fairly. When abduction fails, it is rarely the method at fault. More often, it is because some internal political faction identifies with one explanation or another or because firms prefer to rush to easy but unsubstantiated conclusions.

Inductive, deductive, and abductive learning approaches are not mutually exclusive. They can and should be applied in the same organisation at different times or to different knowledge gaps. But, powerful as they are, sometimes none of the three approaches alone is sufficient. This is the case for the most problematic knowledge gaps, those that start from very limited understanding but which are critical to commercial success. For example, what is the segmentation in this market (declarative), what causes segments’ different behaviours (causal) and how does each segment reach their decision (procedural).

In such cases, a mixed-method approach is usually required, which means using more than one learning method but combining them for complementarity. In our market segmentation case, for example, we might begin with inductive methods to understand the motivations that underlie segmentation, deductive methods to find the causes of their behavioural difference and abductive methods to unravel their decision processes. The three methods can be used to build on each other in stages, known as a sequential mixed-method approach, or independently to verify or “triangulate” each other, which is known as a convergent mixed-method approach. Predictably, mixed methods approaches require more resources and demand more skill than pure, single-method approaches but they tend to produce better answers to harder questions. As in everything else, the quality and quantity of organisational learning is proportional to the effort applied to it.

Our rapidly changing marketplace makes it more necessary than ever for biomedical companies to learn and to use their new knowledge to sustain their competitive advantage. The exemplar companies in our industry -those that persist on the top company lists for decades - pride themselves on their ability to do this. Yet, at the same time, those market changes places greater pressure on those individuals who must lead organisational learning. Buried under an avalanche of data and armed with evermore powerful information technology options, it is tempting to rely on analysis, chopping up our data in ever more arcane ways. But analysis alone never leads to learning. Any effective approach to learning relies on synthesis, the combination of different sources of information. Inductive, deductive, abductive and mixed-methods are, like cooking, different ways to combine information and whilst analytically dicing the individual ingredients ever more finely has some value it rarely creates new knowledge.

The ultimate lesson from my research then is that organisational learning is essential to long-term survival in a changing market. The learning processes it requires are undoubtedly more difficult and more expensive than the datacrunching that replaces learning in some, lesser firms. But, as the saying goes, if you think knowledge is expensive, you should try ignorance.