Due to emerging factors such as escalating financial risks, lack of new blockbuster drugs and evolving global capabilities, the time is right for US biotechnology firms and Indian pharmaceutical companies to join forces in the pre-commercial phases of drug research and development.

Recent trends in the global pharmaceutical industry suggest that the time may be right for a new business model to emerge. Especially, a model that draws upon the existing strengths of US biotechnology companies and Indian pharmaceutical companies to cost-effectively discover and develop new drugs. This would help simultaneously address the considerable barriers to continued success facing the Big Pharma companies worldwide. These partnerships promise to reduce risks and costs at all stages of the process from discovery to commercialisation, and maintain or increase margins for all participants. Ultimately, this will ensure that important, innovative and new therapies are made available at affordable prices to patients all over the world. As the current global structure of the industry clearly becomes less and less sustainable, the demand for new solutions will grow. This will create an ideal atmosphere for the type of win-win partnership envisioned here.

Today, Big Pharma is in a big squeeze. They are realising diminishing returns from their massive research and development efforts. The costs and risks associated with drug discovery, lead optimisation and pre-clinical and clinical development continue to escalate sharply, while productivity is dwindling. The US$ 100 million Investigational New Drug (IND) threshold has been reached and the US$ 1 billion discovery-to-market threshold looms. At the same time, many of the blockbuster drugs (annual sales >US$ 1 billion) that have driven the industry's remarkable success in recent decades are soon to lose their patent protection. Also, there are very few drugs in the pipeline to replace potentially huge losses in revenue. Recognising these long-term trends, most of the companies in the recent years have been cutting costs associated with their internal R&D activities. This is being done primarily by eliminating non-performing programmes and focussing more tightly on retaining potential drug candidates in specific therapeutic areas.

Rapidly escalating development costs have taken a toll as well. They have elevated the risks involved and the losses incurred when drugs fail in the clinical development phase of the process. Many inevitably do. The stakes have never been higher and the huge cost of failures is making it increasingly difficult to build the losses into the price of the compounds that can successfully make it all the way to market approval and commercialisation.

The global players have turned more and more towards two practices to address this growing imbalance. To maintain the flow of innovative new products, they are feeding their pipelines through licensing deals and acquisitions, often with US biotechnology firms which are the hotbeds of drug discovery today. The exponential growth in the number and value of Phase II in-licensing deals is a strong evidence of the trend. To reduce the risks and costs associated with developing promising compounds, they are outsourcing many pre-clinical and clinical development programs on a fee-for-service basis. Indian and Chinese companies are preferred as many of them have built sophisticated developmental infrastructures at substantially reduced costs.

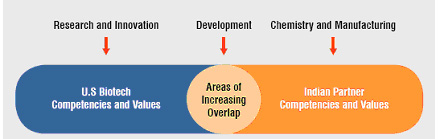

Given these established, well-recognised trends, the next step seems obvious. But so far, not many companies have taken it. In this model, the Indian pharma companies contribute access to their world-class chemistry and manufacturing infrastructures. The US biotechs contribute their advanced research and discovery capabilities. And both partners contribute to the pre-clinical and clinical development activities. This is an area of increasing overlap between the two as Indian companies reverse integrate into clinical development. For example, many Indian pharma companies now have their own animal facilities, Phase I units and even the capability to conduct proof of concept studies. With many US biotechs needing cost-effective access to such developmental resources, there are substantial opportunities for productive and synergistic collaborations.

Figure 1: Indo-US Biopartnering areas of increasing overlap

The US biotechs contribute their advanced research and discovery capabilities. And both partners contribute to the pre-clinical and clinical development activities. This is an area of increasing overlap between the two as Indian companies reverse integrate into clinical development. For example, many Indian pharma companies now have their own animal facilities, Phase I units and even the capability to conduct proof-of-concept studies. With many US biotechs needing cost-effective access to such developmental resources, there are substantial opportunities for productive and synergistic collaborations.

Risks are shared by the participants and the cost-efficiencies achieved in the process create considerable value. These attributes will make the offerings from such partnerships all the more attractive to the Big Pharma. They would then apply their enormous commercialisation capabilities, particularly their global resources in regulatory affairs, sales and marketing. The ability of these partnerships to offer novel drugs that have already achieved proof-of-concept in human, eliminates much of the tremendous early-stage pipeline risk now faced by the Big Pharma. At this point, the potential value of a drug candidate is clear and all of the major pre-clinical safety and efficacy issues have already been addressed. Many drugs still fail at that stage, of course, but the Big Pharma companies are clearly willing to bear the remaining risk and invest the US$ 200-300 million that might be required to get a drug approved.

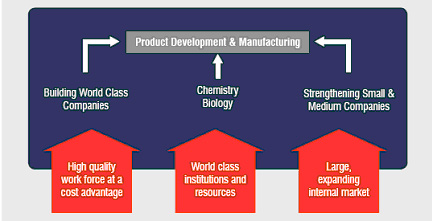

Figure 2: Opportunity for India.?

Innovation and discovery of novel compounds (NCEs)

Expansion into preclinical and clinical development

Over the past several decades, Indian pharmaceutical companies have built an impressive infrastructure of world-class chemistry and manufacturing capabilities. This they have achieved mainly by concentrating on the low-cost production of generic drugs. As the industry has evolved and matured, today there are more than 75 plants in India approved by the US FDA to manufacture drugs for the American market. This is the most in any country outside the US. There is a plentiful trained labour force in pharmaceutical manufacturing and development in India, where labour costs are typically 30-50% of those of US employees. Indian pharmas are driven by the quest to build infrastructure-bricks and mortar and expertise.

The combination of reduced risk and reduced costs will also encourage the development and marketing of new drugs that are not anticipated to be blockbusters. Biotech companies are discovering many drugs today with smaller potential markets. The creation of a model that makes it financially viable to bring them to market will not only help revitalise the pharmaceutical industry, but will also contribute substantially to public health around the world. The benefits of pharmaceutical care will be extended to more diseases.

The Indo-US partnership model represents a natural progression for both partners, playing to the strengths of each other while bridging the gap between them creatively and productively, as the risks and rewards are shared in equal measures.

US biotechnology companies tend to focus their efforts on research and development of portfolios of intellectual property. They are often relatively "virtual" companies, concentrating their investments on intellectual resources and capabilities without building manufacturing facilities, animal facilities, or clinical trial units-they are driven by the quest for innovation in drug discovery. As their candidate compounds evolve, they will typically seek outside relationships to continue the development process. By avoiding cumbersome infrastructures and by targeting their research and development efforts within very specific therapeutic areas, costs are controlled. This model (along with the inherent value of a given intellectual property portfolio, of course) attracts capital investment.

With such a robust industry, however, many Indian pharmas appear to have a strong desire to become global players. Within the context of the generics industry, several Indian companies have bought other generic companies, particularly in Europe. Although such acquisitions expand the companies' critical mass, it will remain difficult for them to forward-integrate into proprietary drugs, as discovery efforts would essentially start from scratch. It will make more sense for them to enthusiastically pursue partnerships along the lines proposed here, integrating the discoveries generated by the US biotechs into their own development infrastructures and jointly moving them forward to the point where Big Pharma come calling with their cheque books in hand.

In this scenario, everyone wins. US biotechs and Indian pharmas maximise their returns based on their core competencies and ensure efficient use of capital and development resources. Big Pharma evolves beyond the nearly-defunct blockbuster model. In the end, patients and consumers win as innovative new drugs become available to treat conditions previously unserved by the pharmaceutical industry. And diminishing drug development costs will help keep overall healthcare costs under control.