Globally, the outsourcing of services for drug development and commercialisation is increasing. Regulatory services are often included in this, and regulatory activities are increasingly the subject of specific, dedicated FSP (functional services partnership) projects. This article overviews a number of the more common models, including cost models, that can be deployed for the outsourcing of regulatory services. We assessed the appropriate criteria and advantages of these models, illustrating with examples from our experience. Interestingly, over the life of a single project, different models may be used, depending on a number of factors and aimed at maximising the benefits to both the supplier and the recipient of these services.

Pharmaceutical companies of all sizes are increasingly outsourcing elements of the development process, including regulatory affairs. This helps them to access specific technical, regulatory or geographic expertise, to flexibly augment staffing levels without adding to headcount, and to deliver key operational outputs enabling internal staff to focus on strategic elements. Outsourced expertise and alternative experiences can significantly inform client strategy. This approach can also provide resources for special projects and support clients for finite periods before their workload enters a predicted ‘trough,’ avoiding the need for the client to reduce its own headcount.

The overall global market for contract research organisation (CRO) services is forecast by ResearchandMarkets to reach US$66.1 billion by 2028, with a compound annual growth rate (CAGR) of 6.6 per cent from 2021 to 2028. A survey by Avoca in 2019 found that clients outsourced 61 per cent of clinical development work and anticipated maintaining that level of outsourcing through 2021.

In regulatory affairs, the global outsourcing market is forecast at US$14.9 billion by 2028, with a CAGR of 11.9 per cent from 2021 to 2028, according to Grand View Research. A driving factor in this growth is the rise in the fixed costs of in-house regulatory affairs functions, including training, technology and facilities.

Large biopharma companies’ use of functional services partnerships (FSPs) – which bundle and conduct repetitive, high-volume tasks across multiple projects – is increasing at more than 13 per cent annually. FSPs can lower sponsor drug development costs by reducing redundant activities, providing scalable expertise and offering resourcing flexibility. Other benefits include simplicity of financing and reduced operational burden.

Typically, outsourcing can be provided either under a full-service offering (FSO) or an FSP model; FSOs generally involve a single protocol or project with multiple services and include project management of the study. FSPs usually involve multiple protocols, products or projects around a single service or a limited set of complementary services such as regulatory and pharmacovigilance, data management, or medical writing. Clients allocate an estimated 45 per cent of outsourcing spend to FSPs and the remaining 55 per cent to full-service offerings. While FSPs are often viewed as a way for a client to gain access to a specific service, these engagements increasingly involve multiple services to ensure a smooth and integrated delivery of projects.

Regulatory services are often the subject of dedicated FSP projects, with quality and success measured using wellestablished parameters, so that clients can compare results achieved by various providers.

Typical regulatory affairs outputs for FSP services include staff augmentation for specific teams (e.g., CMC), end-toend delivery of single or multiple MAAs/ NDAs, managing activities in specific countries or regions, and responsibility for post-approval activities for specific products or regions. Services in these areas can range from project leadership, planning/strategy, authoring, publishing, submissions, interactions with regulatory authorities, and database and system maintenance.

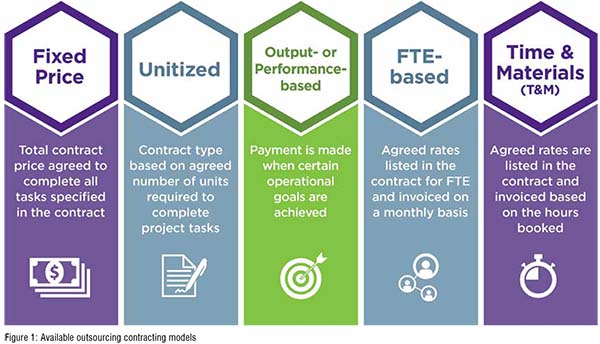

There are five main types of FSP cost models (Figure 1):

• In a fixed price model, the total cost to complete all tasks specified in the contract is agreed in advance. This has the clear benefit that sponsors can budget for known costs, which are spread predictably over the duration of the study lifecycle. This could be highly applicable to a client with a known budget or budget cap and where the tasks are well established and understood.

• Unitised models involve clients paying for units of work or tasks delivered. This might be best for a client where the volume of work flexes up or down over time, where the hours per unit and volume of work are well established and predictable, or the units involved are well established and understood. Where units are not well understood, and/or the process by which units are generated and delivered is not yet understood, a pilot phase can be helpful. Here, unit delivery, hours and resources are carefully measured and can be used to establish robust units. This model incentivises all parties to find efficiencies.

• For output or performance-based models, fees depend on the achievement of pre-specified milestones with or without associated timelines and may include bonus or penalty options. This would be helpful where the client has planned key milestones, and also allows budget to be aligned to the overall timelines for deliverables. As an example, a provider is hired to prepare and to submit a Marketing Application Authorisation (MAA) to a specific regulatory authority on or before a predetermined date. This model might include a bonus for meeting the target timeline and/or a penalty for failing to do so. This model incentivises the provider to deliver to the specific target milestone, though it needs to take into account that unforeseen circumstances beyond the control of the provider may impact the outcome (e.g., unexpected Phase 3 results or delays in provision of data by the client).

• A full-time equivalent (FTE)- based model provides the client with a variable number of FTEs, who may be 100 per cent or a part-assigned to development efforts across one or more functional areas. This model can provide expert services in all areas, including regulatory affairs, and might suit a project where the number of units or outputs is hard to predict, but the workload is reasonably well established. This approach is often used when there is a short- or mid-term need to supplement a client’s own staff due to shortages, turnover or large influxes of work. This model incentivises the client to carefully consider what resources really are required, at what level and for how long. In addition, it ensures that the provider carefully forecasts and plans resource allocations.

• A time and materials (T&M) model is common for projects with tasks where the time needed to perform each task is not easy to predict. As a result, the client receives an estimate upfront, but is only charged for the actual time spent. This might be appropriate for a client looking for consulting services or a one-off project with a small number of units or where complexities may increase or decrease the hours taken to complete a task. Sometimes, a T&M model is used as a pilot, in order to measure time taken and then establish robust units for a subsequent contract. An advantage of this type of model is ease of contracting and administration for both parties.

In addition, a hybrid model consisting of more than one of the above models offers the flexibility to create optimised, highly tailored solutions that may have the greatest impact on key operational metrics and deliverables. Effective use of metrics and key performance indicators (KPIs) can inform ongoing outsourcing decisions and drive process improvements. There also is flexibility to change models during the life of a single project.

Staffing throughout product development – from early development plans and pre-clinical stages, through to clinical trials and peri- and post-approval activities – requires a strategic approach. This involves examining the portfolio and available internal talent resources, and then determining the best solution to ensure successful delivery for a given asset or program. As client teams evaluate the options, they should consider staffing models that optimise quality and efficiency.

A strong governance structure is of vital importance for a successful partnership. This should be built on transparency and flexibility to support the unique needs of each client. Key elements include provision of a customised and high-touch relationship to clients, with robust oversight from the provider and client leadership teams, and well-defined overarching expectations, requirements and processes. In addition, by acknowledging the mutual desire for enhanced productivity and efficiency, a culture of continuous improvement can be instilled. This should be underwritten by rigorous KPIs, clear communication, risk management, and effective escalation pathways, to maintain compliance and quality throughout the life of the partnership.

Significant expansion of the Chinese pharmaceutical market continues, with sales forecast to rise by 9.8 per cent in 2021. Pharmaceutical innovation is strong in the Asia-Pacific region overall, with more than 5,500 drugs in development as of late 2019.

The many startups in China and the Asia-Pacific region will need to consider outsourcing regulatory services to broaden their global footprint and achieve worldwide registrations for their assets. Here, experienced CROs can provide staff and expertise in locations such as the U.S. and European Union, significantly increasing the capacity of these emerging companies to submit and market their products globally.

A third case study describes successful provision of regulatory resources in China.

The following three case studies provide real examples of the different types of FSP models in action.

FSP Case Study 1

Proven Partnership: Lifecycle Management and Post-Approval License Maintenance

Model type: Unit-based, maturing to FTE-based after six years

Background

• Partnership has been in place since 2013.

• Over 48,700 lifecycle management (LCM) submissions were delivered for 54 products in 165 countries by the end of Q1 2021.

• Managed through established processes, KPIs and training.

Solution

• Dedicated individuals lead portfolio management and planning/delivery of regulatory submissions.

• Flexibility, quality and predictable cost helps smooth peaks and troughs in work volumes.

• Established KPIs are monitored, with timely intervention and resolution if there are deviations.

Benefits

• Partnership provided cost savings of approximately 25 per cent to the client over eight years.

• Cost per unit was reduced by up to 60 per cent in the first five years of the partnership.

• Quality of delivery is guaranteed through effective monitoring and oversight.

• Flexible model transitioned from unitised to FTE as the project evolved.

FSP Case Study 2

Exceeding a Client’s Corporate Goals: Faster Successful Delivery of U.S. and EU Marketing Applications

Model type: Mixed (with some FTE staff and initial SME T&M tasks that transitioned to unitised tasks)

Background

• A PPD client needed support for marketing submissions to the U.S. and EU (centralised procedure) for three development programs.

• The client required strategic input, subject matter expert (SME) authoring and review, quality review, document publishing, and post-submission support.

Solution

• An FTE-based project management office set strategy, resolved issues and applied efficiencies.

• Compound-level workstreams were developed.

• FTE-based regulatory affairs leads and functional SMEs focused on deliverables, with dedicated resources for authoring, CMC, nonclinical and management roles.

• SME support was provided initially through a T&M model, which evolved into a unitized model.

Benefits

• High-quality EU MAAs were filed within nine months of project initiation, compared with a typical 12-month timeline. The client exceeded its corporate goals for launch.

• Services were later expanded to support additional markets and tasks.

Case Study 3:

Rapid Onboarding in Challenging Hiring Location Model type: FTE

Background

• Client needed six regulatory FTEs in China for six months of support.

• Traditionally challenging to hire qualified candidates needed in China with short notice, with an average of 60+ days’ time to hire in this competitive market.

• FTEs needed to start ASAP upon award.

Solution

• PPD’s China leadership ensured sufficient support and resourcing from top-level management.

• PPD HR implemented an aggressive recruitment plan, led by a dedicated recruiter.

• Two FTEs moved from existing teams to lessen hiring burden.

• RA team customized a streamlined onboarding/training plan.

• Clear communication and rapid decision-making.

Client benefits

• Six FTEs identified and onboarded one month sooner than agreed.

• Client extended contract for an additional six months to meet continued needs.

Conclusions and lessons learned

The various FSP models in regulatory affairs provide a wide range of benefits and integrated client-provider partnerships offer efficiency and flexibility to manage regulatory workflows. These increase capacity, add capabilities, and free up in-house resources. FSP models enable specific expertise to be leveraged with flexibility to expand and extend the services and contractual model. Keys to success include clarity upfront for both parties on the scope of work involved, the need to devote time at the outset to ensure expectations are clear, and continued transparent communication throughout the engagement.

As the regulatory environment continues to evolve and as clients seek effective solutions to ensure regulatory compliance and the earliest possible approval of assets globally, these models offer flexibility to deliver both regulatory success and financially prudent contracts.

References:

1. https://www.globenewswire.com/en/news-release/2021/03/01/2183950/28124/en/Global-Healthcare-Contract-Research-Organization-Market-Report-2021-Clinical-Trial-Services-Dominated-the-Market-in-2020-with-a-Share-of-76-7-Forecast-to-2028.html

2. Salotti D. Avoca Group's Industry Research Report on Clinical Outsourcing: Spend, Models, and Measures. Applied Clinical Trials, September 12, 2019.

https://www.appliedclinicaltrialsonline.com/view/avoca-groups-industry-research-report-clinical-outsourcing-spend-models-and-measures

3. Grand View Research web page, Regulatory Affairs Outsourcing Market Size Worth $14.9 Billion By 2028. January 2021. https://www.grandviewresearch.com/press-release/global-regulatory-affairs-outsourcing-market

4. Madichie E et al. Leveraging Next-Gen FSP Models to Better Manage Post-approval Regulatory Workloads. Contract Pharma. September 5, 2017. https://www.contractpharma.com/issues/2017-05-01/view_features/leveraging-next-gen-fsp-models-to-better-manage-post-approval-regulatory-

workloads/

5. https://www.appliedclinicaltrialsonline.com/view/the-rise-of-fsp-outsourcing-in-drug-development (Sept. 2020)

6. https://www.clinicalleader.com/doc/the-benefits-of-a-functional-service-provider-fsp-model-in-uncertain-times-0001 (May 2021)

7. https://www.clinicalleader.com/doc/is-a-functional-service-provider-fsp-model-the-right-fit-for-your-clinical-study-0001 (July 2018)

8. King T. Flex Your Outsourcing Model to Maximize Drug Development. Contract Pharma, September 16, 2019. https://www.contractpharma.com/issues/2019-09-01/view_features/flex-your-outsourcing-model-to-maximize-drug-development/

9. http://staging.signalinc.com/PPD0154/email3/

10. Ackermann AC, Cairns S. China: Pharma in the year of the Ox. February 18, 2021. https://ihsmarkit.com/research-analysis/china-pharma-in-the-year-of-the-ox.html

11. PMLive, Pharmaceutical innovation in the APAC region. November 12, 2019. http://www.pmlive.com/pharma_intelligence/Pharmaceutical_innovation_in_the_APAC_region_1315357