Despite all the current hype, Artificial Intelligence (AI) is in its infancy in the commercial part of the pharma value chain. Its benefits are in the distance and, for the foreseeable future, available only to special cases where there is lots of freely available data to work with. And this focus on AI can blind us to the hugely valuable resource that almost all life science companies have at their fingertips, their Natural Intelligence. Natural Intelligence (NI) is the ability to take the information we already have and synthesise it to create compelling and commercially valuable market insight on which to build our strategy.

Despite the hype, the routine use of AI in marketing in the life sciences is a long way away. Much of what is sold as AI is, in fact, just old-fashioned analytics that, whilst useful, is not novel. True AI is already making some contribution in areas such as drug discovery, where it can be applied to large data sets. But in marketing, where the problems are sociological rather than technological and data are often limited, the hysteria around AI is more of a distraction than a benefit. In particular, the bubble around AI often draws attention away from the value that can be added without big data, massive processing power or expensive consultants. For most marketers in pharma and medtech, there is a more practical approach. Millions of years of evolution have gifted life science marketers with the best information processors in the universe. It is sitting between our ears, if we know how to use it.

My research work concerns how life science companies are evolving, with a particular interest in their commercial models. My observations of how the best life science companies approach strategic marketing planning reveals that the best results come from the application not of novel techniques but from what we might instead call NI. There seem to be three broad approaches to the use of NI in marketing. These are easily applied, using existing or readily available information, and they provide enormously valuable insights to guide strategy and create competitive advantage. Their simplicity might make them seem obvious to you but they are not used by most life science marketers and they are a source of relative competitive advantage. Consider the examples below and how you might apply them to your strategic marketing planning.

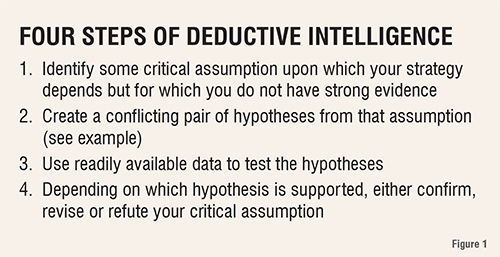

Deductive intelligence is the bedrock of the physical and natural sciences, but life science marketers make relatively little use of it. It involves four steps (Figure 1). For example, you might strongly believe that your sales are suffering because of the high price of your product, relative to a competitor. Acting on this assumption might require price discounting or the costs of enhancing the product. Before you do so, develop a pair of conflicting hypotheses from your strongly held assumption. For example:

H0 If price is an issue, market share should be the same or similar in all sales regions

H1 If price is not the issue, market share should vary significantly between sales regions

These hypotheses can of course be tested by looking at regional sales data. If market share is reduced evenly across regions, then your assumption about price is probably, although not necessarily, correct. If however market share is low in some regions and high in others,then you should consider another explanation, such as sales team skills or customer segmentation varying by region. If the hypothesis testing leads to another belief, then that can be tested in the same way. In either case, using deductive intelligence to test assumptions means plans are built on better information.

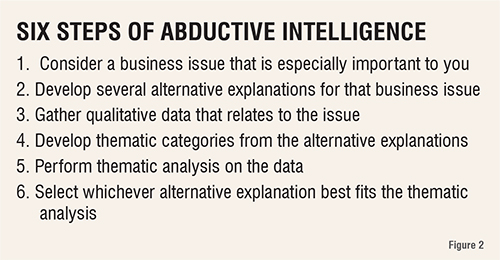

Abductive intelligence Is especially useful for ‘seeing the wood for the trees’ problems. It has six steps (Figure 2). For example, you might want to understand why the uptake of an innovative product is slower than expected. You and your colleagues may have a number of alternative explanations ranging from price, to performance to slow customer decision making. Based on those untested explanations, it is relatively easy to carry out, for example, interviews with a representative set of customers. Importantly, the interview questions should be open (“Tell me about how you decide to adopt new products like X”) not closed (“Is the price putting you off adopting X?”). You can then develop a categorisation scheme based on the alternative explanations. For example, you might categorise all mentions of price concern as ‘price problems’ and all mentions around internal discussions as ‘Internal decision making’. Analysing the interviews to see which categories are found in the data, you can look for emerging themes, such as how often price is mentioned directly or indirectly, or how often different aspects of internal politics are mentioned. You can then assess the strength and frequency of themes and use that to decide which of the alternative explanations seems to best fit with the emergent themes.

One of the putative explanations may emerge as very well supported, or more than one explanation might contribute to the slow uptake of the product. Whatever the case, the outcome informs how you might resolve the business issue and accelerate uptake.

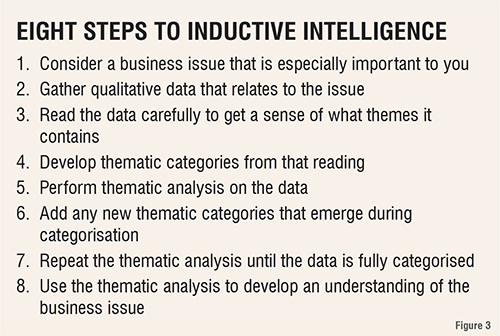

Inductive intelligence is used to generate completely new information, rather than test what we think we know. It has some similarities with abductive intelligence but has 8 steps (Figure 3). For example, you might want to understand why patient adherence to a treatment regime is so poor but have no clear idea why this might be. Without hypothesising or suggesting explanations, you could carry out, for example, interviews with a patients, prescribers and carers. Again, the interview questions should be open (‘Tell me about taking your medicine’) not closed (‘Are the injections putting you off taking your medicine?’). Then, and again without hypothesising or trying to think of alternative explanations, you can read and re-read the interviews several times. From this reading, several explanations of non-adherence emerge and these can be used as categories, as in abductive intelligence. The interviews are then analysed for phrases using the emergent categories.

However, as this analysis takes be added place, new categories might emerge and added to the analysis framework. The interviews should be repeatedly analysed until most of the interview transcript is categorised with either the original or newly emergent categories and no possible explanation of non-adherence is left uncategorised. The strongest and most frequent of these categories then leads to one or more explanations of the business issue, in this case non-adherence, even when none was initially apparent. This new explanation informs how patient adherence, and therefore outcomes, might be improved.

As the philosopher Daniel Dennett put it, a carpenter can’t do much woodwork without woodworking tools and we can’t do much thinking without thinking tools. In the same way, a life science marketer can’t make strong strategy without these three strategic thinking methods. The three methods are both alternatives and complements. Each has their own place in the process for understanding the business situation but they can also be used together. Deductive intelligence is especially useful when one begins with an unsupported belief and wants to get to a stronger, more supported planning assumption. It is the alternative to acting on “gut feel” and reducing the strategic marketing plan to an expensive experiment. Abductive intelligence comes into play when the there is disagreement in the team and several alternative views are competing to drive the strategy. It is the alternative to allowing the loudest voice or most powerful person dictate the strategy. Inductive intelligence is at its best in new situations or when the team does not have much experience of the market. It is the alternative to assuming that this market behaves like other, more familiar markets when there is no evidence that it does. And of course the three kinds of intelligence are complementary. For example, inductive intelligence might generate multiple explanations of, say, the mental algorithm that prescribers use to choose what to prescribe. These can be narrowed down by abductive intelligence to the most likely explanation. The final, most likely, explanation can then be tested using deductive intelligence. The end result is that natural intelligence, usually using existing or readily available data, produces knowledge that is a better foundation for strategic marketing planning. This means that the strategic plan has a higher probability of meeting its goals, which is, ultimately, the test of a marketing strategy.