This third article in the series addresses the second, key question of glocalisation: How should we adapt our global strategy to our local markets? Current practice, which defaults to change only what must be changed, is naïve, undervalues local affiliates and fails to create competitive advantage. This article identifies the three flaws in that approach and the three habits that characterise more astute glocalisers. It then sets up article four, which looks at how life science firms learn from their glocalisation.

The first article in this series began from the premise that exploiting global markets creates a dilemma for pharmaceutical and other life sciences companies, which I called the glocalisation challenge. This is the need to adapt to local market conditions whilst adhering to a global strategy. That first article identified the three parts of that challenge and the second article addressed the first of those: how to allocate the right amount of the right kind of resources to the right markets. This article, the third of the series, addresses the second part of the glocalisation challenge: how to adapt to the market conditions of the targeted countries.

The most striking finding of my research is that most pharmaceutical companies take an “isomorphic” approach to glocalisation; i.e. they copy what they see others doing and call it “adopting best practice”. In fact, there is rarely any evidence that what they are emulating is best practice and, even if it were, this isomorphic behaviour ignores the important differences between different companies’ goals, strategies and cultures. When executing global strategies in local markets, isomorphic behaviour is typically minimalist. It begins with making essential changes, for example to meet local language, regulatory, reimbursement and other market access requirements. It ends with making minor tweaks to marketing communications, such as adapting the mix to local media or changing imagery to reflect local use. In other words, isomorphic adaptation of global strategy is usually limited to the 2 Es: The essential and the easy.

This minimalist approach is necessary but not sufficient for success. It limits the ability of the firm to create compelling customer preference by neglecting the three key factors that make each market different from other, even neighbouring, markets. It neglects the local competitive environment, it neglects market heterogeneity and it neglects the “beyond the pill” needs of the targeted market segments, as discussed in article 2, The Glocalisation Choice.

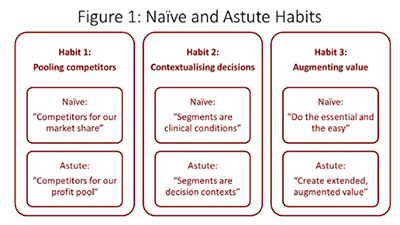

But whilst most companies are naïve in this way, not all are. In my research, I’ve found that a few exemplary companies, those I refer to as astute globalisers, attend to these three neglected factors with marketing processes that are quite different from those of their naïve peers. They have different, more sophisticated habits for competitive analysis, market segmentation and value proposition design. In figure one and in the next three sections, I’ll describe those three important differences and explain how they enable more effective glocalisation.

When I observe naïve glocalisers, their definition of competitors is “any firm selling similar products”. That is, competitors are those who compete for market share. This is an operationally useful way of framing proximal competitors but it is strategically myopic. By contrast, astute glocalisers take a much wider view. To them, a competitor is anyone who want to drink from the same pool of profit associated with the market. In other words, they frame competition in much the same way as Porter did in his 1980 seminal work “Competitive Strategy”. In that framing, competitive pressures can come from many directions. For example, in many Asia-Pacific primary care markets, traditional remedies are as much of a rival as more obvious, direct competitors. And in mature markets, large customers such as state and private insurers or healthcare providers may be the most significant rivals for the profit pool.

What makes this habit valuable is that whilst a global strategy probably usually includes positioning against direct, similar competitors, it may disregard the blend of substitutes, new entrants, buyers and suppliers that create the unique competitive conditions of the targeted market. The habit of thinking of your competitors as those who drink from your market’s profit pool, not just those who compete for market share, is, therefore, the first big difference between naïve and astute glocalisers. It is a necessary precursor to adapting the global strategy to local markets in a way that creates competitive advantage.

All markets are heterogeneous, meaning that even patients with same condition, prescribers with the same role and payers in the same kind of organisation differ significantly in their needs, motivations, attitudes and, consequently, value-seeking preferences. Understanding and adapting to this three-dimensional heterogeneity is critical to effective glocalisation and it is the second big difference between naïve and the astute glocalisers.

Naïve glocalisers are often driven by global brand plan templates and other aspects of an inflexible, top-down culture. As a result, they tend to mimic the market segmentation described in global plans with little or no adjustment for local conditions. This has the benefits of simplicity and compliance with global views but those benefits come at the cost of reduced competitiveness. That’s because they discount the subtle differences in local market heterogeneity that appear trivial from Paris, Chicago or Tokyo but are commercially consequential in Shanghai, Mumbai, or Kuala Lumpur. In other words, the brand plans of naïve globalisers often use global market segments even when they know them to be crude approximations of local reality.

Astute glocalisers do not the segmentation that comes with global plans but neither do they follow it slavishly. Instead, they use it as a starting point. In particular, they build on the often one-dimensional global segmentation that is usually expressed as a disease condition. Onto this they add non-clinical patient attributes, such as adherence behaviours or engagement with treatment decisions. Then they add in the heterogeneity of prescribers and professionals, usually also created by a combination of tangible and intangible drivers. Finally, they overlay the heterogeneity of local payers, which often exists at both national level (for example, insured vs out of pocket) and account level (for example value- and price-driven local formularies). Collectively, this approach is called contextual segmentation because it describes the complete context of the prescribing or usage decision.

Using the global view of market segmentation as starting point for contextual segmentation, rather than applying it locally without adaptation, has a cost. This habit requires deep market insight and the courage to tell head office that their view is insufficiently nuanced. But paying those costs gives astute glocalisers an advantage over their naïve rivals. Their richer, deeper understanding of the local market’s contextual segmentation puts astute glocalisers in a position to create much stronger and more compelling value propositions.

The minimalist, “do only what’s essential and easy” approach of naïve globalisers is most visible in the multitude of value creating activities that are involved in strategy execution. Naïve globalisers focus on the essentials of gaining regulatory and reimbursement access and the easy of adapting marketing communications to local media and culture. In an increasingly digital world, even the latter is becoming a minor task. Fundamentally, the naïve habit of executing strategy involves adoption of the global strategy’s core value proposition with minimal change. Typically, this core offer is centred on a clinical value proposition of efficacy compared to direct rivals. In other words, naïve glocalisers do little more than translate the global strategy’s clinical claims into local language. This minimalist-adaptation habit is shaped by the first two habits of defining competition narrowly and understanding market segmentation simplistically. The cumulative outcome of all three naïve habits is that, unless the clinical claims are outstandingly differentiated (a rare and even temporary situation in today’s markets), the added value perceived by patients, prescribers and payers is small. Perceiving low added value, payers then do what they are paid to do; play rivals against each other to put price pressure on all manufacturers.

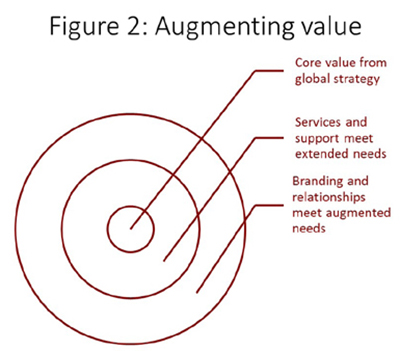

The astute glocalisers’ strategy execution habit is also shaped by how they have defined competition (widely) and market segmentation (contextually). Because, unlike their naïve comparators, they have a multidimensional understanding of the competitive environment, they have a better appreciation of their customers’ framing of relative value. And because they have a richer, deeper and contextualised understanding of patients’, prescribers’ and payers’ motivations, they are clearer about how to create value. Together, these advantages allow them to build on the “core” value proposition from the global strategy in two steps, as shown in figure 2. First, they add a layer of extended value; for example risk-sharing price deals that address payers’ conservativeness, or education programmes that address prescribers’ fears of misprescribing. Then they add a layer of augmented value; for example, their opinion leader programmes address the self-actualisation needs of key professionals and branding messages address the reassurance needs of “laggard” segments. Their target segments’ perception of superior value, based on everything they experience, allows astute firms to avoid the price pressure faced by naïve glocalisers.

To steal from Aristotle, glocalisers are the sum of their habits. Naïve glocalisers’ habits of limiting themselves to the “essential and easy” means they take a narrow view of competition, adopt global segments without local adaptation and simply echo the core value proposition that comes with the global strategy. Astute glocalisers’ habits of using global strategy as a starting point means they compete for the profit pool, not market share. To do so, they work hard to understand the rich, multidimensional, contextual segmentation that makes their market unique. They use this to build extended, augmented value propositions that create added value in the eyes of their customers.

These differences have three consequences that astute leaders in the life sciences industry grasp but naïve glocalisers don’t. First, it means that astute glocalisers create competitive advantage and shareholder value. Second, it means that local affiliates have a much bigger, more value adding role than merely executing headquarters’ instructions. Finally, it means that local affiliates can be a rich source of organisational learning for the wider, global organisation. It is to that last point that I will turn to in article four.