Done well, this process avoids the three dangers of isomorphic targeting.

In the first article in this series (“The Glocalisation Challenge”), I differentiated between astute and naïve glocalisers and, in this fourth and final article, I describe the most undervalued difference between them. For astute glocalisers, local execution of global strategies goes further than allocating effort between national affiliates (see article two, “The Glocalisation Choice”). It also goes beyond how those affiliates adapt global strategy to local market conditions (article three, “The Glocalisation Change”). They also sustain and expand their success by using glocalisation as a classroom. They deliberately learn lessons from their affiliates and spread them around the firm. This article describes how they do that in practice.

Let’s assume that you have assimilated and acted on the lessons from the first three articles in this series. You have understood that there is a capability chasm between those life science companies that are astute and those that are naïve. You have learned not to target countries naively, by market size, but astutely, according to the winnable segment size. And you have learned not to adapt to local markets by naively making only the essential and easy changes but by astutely building augmented value propositions around contextual segments. If you have done all that, then your results will be more like those of the astute companies I studied and less like the naïve ones. But you will still have an important question to answer: how do we sustain our glocalisation success?

Sustaining success is difficult because market change is a constant and what worked yesterday may not work tomorrow. That’s why the respected academics Sparrow and Hodgkinson said that, in a changing market, a firm’s only sustainable competitive advantage is its ability to learn. But how do firms learn and, in particular, how do pharma, medtech and other life science firms learn from and about glocalisation? Let’s begin with how naïve glocalisers try and fail to learn.

You might be familiar with the following scenario from your present or past firm. Key people from each affiliate in a region, or globally, are invited to a meeting. Most of the agenda is HQ communicating the global strategy to the affiliates. But there’s also a session about sharing best practice. In that session, the affiliates are asked to share their successes and failures, although naturally they focus on the former. These successes are held up as “best practice” and the other affiliates are encouraged to copy them. It has the obvious credibility of being a proven, real-world case study in your own company, analogous to learning from a sibling. For naïve glocalisers, this imitation of perceived best practice of friends and colleagues is the default approach to learning and adapting to market changes.

But this kind of best practice is illusory and it hinders learning and adaptation as much as it helps. It is illusory because it is built on the assumption that what works in one country will work with only minor adaptation in another because the company and its products are the same. This is often a false assumption because even affiliates in the same region can be working in markets that differ in important ways. I mentioned some of those important differences between markets, such as competitive activity and segmentation patterns, in article two, “The Glocalization Choice”. And this kind of best practice imitation can hinder adaptation because mimicry drives value proposition design instead of market needs.

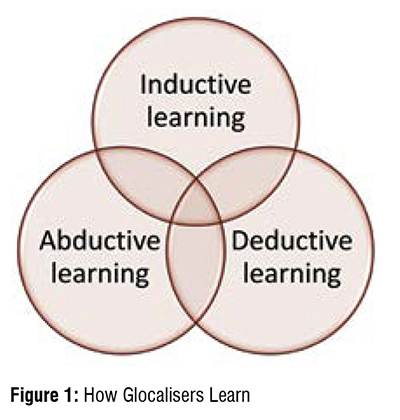

So if sharing and copying illusory best practice is the default of naïve glocalisers, how do astute glocalisers learn from and about glocalisation? In my research, I observe three approaches to learning. The most astute glocalisers use all three in a complementary manner, as summarised in figure 1.

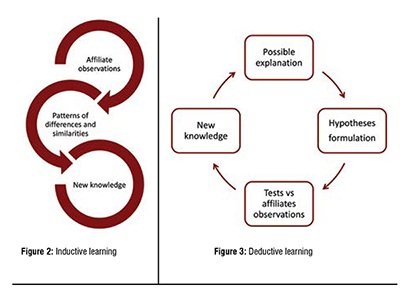

The most prevalent approach to learning among astute glocalisers is the inductive approach. This is a form of “pattern seeking”, as shown in figure 2. It involves searching across a range of national affiliates for similarities and differences in what works and what does not and then drawing a conclusion about the lessons to be learned. In companies I’ve worked with, inductively-drawn lessons have included the heterogeneity of payer behaviours and the role of communities of practice in influencing new product adoption. Inductive learning works best when there is someone, typically with regional responsibility, who has an open mind and looks at affiliates objectively. That objectivity allows them to be receptive to the successes and failures of the affiliates and to find the patterns in their activity and outcomes. Induction fails when there is no one in that role or when that person comes with fixed opinions. In that case, the process is thwarted by the cognitive bias that psychologists call “confirmation bias” and inductive learning becomes no more effective than the best practice illusion. Typically, inductive learning is used most when a firm is unclear about both what it needs to learn and how to learn.

Deductive learning is more methodical and less prevalent than inductive learning. It parallels the scientific method that evaluates a theory, via a pair of hypotheses, to learn something new, as shown in figure 3. Deductive learning is best explained by one real world example I observed. The company believed, but did not know, that uptake of a women’s health product in Asia Pacific was hindered by cultural attitudes towards this therapy area. From that putative explanation of why uptake varied, they created a pair of hypotheses to test:

By comparing uptake across a number of affiliates, they found H0 was better supported by the real world data. Although this did not give them a new explanation of uptake, it did remove an old, incorrect explanation, which is just as useful.

Both inductive and deductive learning need a thoughtful person in a regional role to own the learning process. Unlike inductive learning, deductive learning needs a working theory, testable hypotheses and sufficient data for evaluating them. Deductive learning fails when firms cannot make their working theories explicit, or if hypotheses are poorly designed or if they misinterpret data. As you can imagine, deductive learning processes are most effective when the firm has a scientific, data-driven culture.

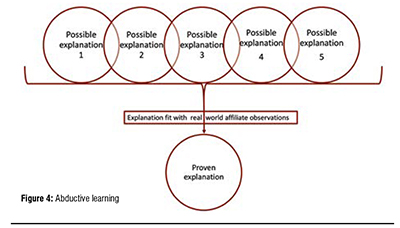

The least common but often most effective way that glocalisers learn is by abduction. This combines elements of induction and deduction, although it is a distinct approach in its own right. Abductive learning works by finding which of several explanations best explain the real world, as shown in figure 4. In my research, I found the Asia-Pacific women’s health company, mentioned above, used abduction to build on their deductive process. They had five putative explanations of why uptake varied between their affiliates in the Asia-Pacific region:

They then evaluated the five possible explanations against the quantitative data, looking for correlations. They complemented this with a qualitative research programme of focus groups, which looked for causal mechanisms. They found that the level of economic development was the dominant influence on uptake but it was significantly moderated by women’s education level, with the other three factors being relatively unimportant. This practical, useful finding strongly shaped their strategy.

As well as needing someone in a regional role who is skilled and committed to drive it, abductive learning works best when there are multiple competing explanations for the business issue you are interested in, such as uptake, market share or customer attitudes. It fails when a single reason is taken for granted or when firms cannot identify alternative possible explanations for the issue. Abductive learning works best in firms with a pragmatic culture who are not too obsessed with numerical analysis.

As always, the inspiration for my glocalisation research was curiosity. Global life science companies are often very similar in their size, structure and strategy. Yet they differ greatly in how well they translate core, global strategies into local ones and how much value their national affiliates create. As I studied these companies, the difference between astute glocalisers and their naïve peers emerged. As I described in “The Glocalisation Challenge”, they differed in how they targeted, tailored and learned. Astute targeting is the result of clever competitive analysis, super segmentation and prioritising differently between countries, as I described in “The Glocalisation Choice”. Then, in “The Glocalisation Change”, I looked closely into astute tailoring and saw the building of layers of value around contextual market segments. And finally, in this article, I unpicked the ways that astute companies learn from glocalisation. They use a mixture of induction, deduction and abduction, making the global operations a classroom in which they learn to sustain their success.

Despite the complexity of my research and the richness of its findings, there is one salient difference between astute, successful glocalisers and their naïve, less successful rivals. It is their attitude towards strategy in general and glocalisation in particular. The naïve think it is unimportant and treat local affiliates as a little more than local concierges. Astute, exemplary companies see glocalisation of strategy as critical and view effective affiliates as vital to it.