This article discusses globalisation trends, outlines the benefits of strategic partnerships and outsourcing, and shows how to overcome the challenges associated with clinical trial management on a global scale.

Multinational biopharmaceutical companies abandoned the practice of performing all of their Research & Development (R&D) functions in house years ago, but the drivers behind the decision to outsource are changing. While the need to reduce fixed costs remains a primary reason for big pharma's dependence on outsourcing partners, a recent study found that improving quality and speeding time to market were actually cited more often as motivators. This is accompanied by the growing trend for companies to develop strategic relationships with vendors who can demonstrate excellence in a range of closely related drug development services such as those that support patient and clinical supply management.

When companies practice strategic outsourcing and work closely with a select few vendors, producing cost savings is a baseline requirement. The real value?and what companies should expect from such long-term relationships?comes in process and technology innovations that lead to competitive advantage. By virtue of their wide experience across sponsor companies and deep functional specialisation, the best service providers have actually developed greater expertise in their particular niche than sponsor companies. This should translate into transformative advances that improve quality and speed time to market.

But this begs the question: how can the relationship be nurtured to provide this expected value? Here we offer insight into current outsourcing trends for managing patients and clinical supplies during drug development and share advice on how to ensure that strategic outsourcing yields optimal results.

One of the basic questions that companies must answer when developing their R&D outsourcing strategy is whether it is best to consolidate services with a vendor offering ?one-stop shopping? or to work directly with a select few vendors offering specialised services. (Working with a long list of preferred providers responsible for each distinct drug development task has long since proven too costly and unwieldy to be a viable option.)

In theory, of course, there are advantages to working with a sole-source vendor?chief among them is the convenience factor. However, sponsor companies taking this approach must be sensitive to the fact that in such a complex industry, it is unrealistic for any single supplier to ?do it all well??just as it was difficult for pharmacos themselves to excel in every aspect of R&D before they began outsourcing. Neither will a provider that attempts to be master of all domains have the management focus or ability to invest in each niche to deliver excellence consistently.

One way around this is for the primary vendor (such as a CRO) to subcontract with specialty providers (such as those offering patient and supply chain management) who can work effectively with them and integrate services. While this is a workable model, it does not give sponsors with high study volumes the maximum opportunity for continuous improvement and value creation.

Another option is to adopt a "best-of-breed" model in which the sponsor contracts directly with a small network of specialised providers that are leaders in their respective areas and capable of collaborating effectively to meet the sponsor's goals. This does not mean that one should have to turn to separate vendors for every individual responsibility involved in setting up and running a clinical trial; market leaders have integrated their services within their areas of expertise, limiting the number of players required.

This best-of-breed approach, when orchestrated properly, capitalises on the focused core competencies and nimbleness of each contributor, yet results in an integrated solution. The challenge, of course, is in governing the relationships with all parties efficiently and effectively..

A recent assessment of strategic partnerships between sponsors and R&D vendors has revealed a mixed degree of success to date. According to a 2012 survey by the Avoca Group, one fifth (22 percent) of pharmacos have discontinued their strategic agreements with outsourcing partners due to poor performance, and 40 percent admitted that expectations for operational efficiencies were being met only some of the time.

We surmise that the reasons for these results are that not all vendors are equally capable across all tasks in all regions and that the need to adjust capacity rapidly has introduced quality-related challenges for some vendors. So, how can this track record be improved?

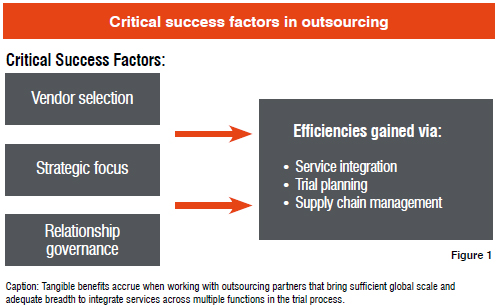

Choosing the right partners is, of course, essential. To qualify as an integrated services outsourcing partner, a firm needs to demonstrate that it has the experience, expertise, and scale to consistently deliver quality results with the necessary speed. Vendors should bring deep domain expertise, insight into regional norms, and a complete understanding of applicable regulatory and safety issues, since errors, or even a learning curve, cannot be tolerated.

To contribute to the success of a strategic outsourcing arrangement, providers must also be willing to commit to a long-term relationship, immersing themselves in the sponsor's business to understand it with an insider's perspective. They must also have sufficient scale and breadth to support global trials, while also being flexible enough to adapt to changing requirements. These relationships generally involve large volumes of work that often prove to be overwhelming for boutique firms. Outsourcing partners in this model must also be open to working collaboratively with other parties in the mix.

And specifically in patient and supply management, vendors should understand the flow of work and data throughout the trial process to ensure that systems feed one another in real time, giving the sponsor maximum control and transparency into key performance indicators.

One of the primary objectives of a strategic outsourcing relationship is to collaborate on engineering out costs. This should not be confused with treating every aspect of the outsourced service as a commodity in an attempt to push down unit costs. Doing so undermines the whole premise of strategic outsourcing as a means to identify process and technology improvements that yield a competitive advantage.

Finding the breakthroughs that deliver business value necessitates that a sponsor spend time on managing and continually refining its support services. A strategic outsourcing relationship will only live up to its full potential when there is alignment of strategic goals, active engagement from both sides of the relationship, openness to process evolution, and controlled experimentation.

How the relationship between the sponsor and its outsourcing partner(s) is governed is a critical factor in ensuring that the relationship transcends tactical execution and truly addresses more strategic goals. Companies must follow a disciplined process that entails:

Clearly, all parties need to invest in the partnership, committing the necessary resources to keep it thriving over the long haul. The goal is to maintain a win-win relationship that results in higher quality and faster drug development at a reduced cost.

Providers of services for managing patients and the product supply chain, when working as strategic outsourcers to sponsors, are able to realize efficiencies in three fundamental ways: service integration, thoughtful trial planning, and comprehensive supply chain management.

Forward-thinking firms have invested in the facilities, staff, and technologies to be able to integrate their services in a logical way and deliver them seamlessly to clients. A single company, with an integrated delivery model, can provide aspects of blinded supply manufacturing, packaging and labeling, analytical testing, storage and depot services, and worldwide distribution and logistics, as well as the interactive technologies that power patient enrollment, randomisation, and drug assignment.

There is a significant interdependency between clinical supply management services and the interactive response technologies (IVR/IWR) that are used to connect those clinical supplies with sites and patients. This is most pronounced during the study start-up process with activities such as forecasting supplies, blinded labeling, pooling products, selecting resupply models, and defining the workflow for managing drug returns. Having these services integrated through one vendor that is strong in each of these areas offers many benefits:

Sponsors are increasingly engaging suppliers in the planning process for clinical trials?often beginning with protocol development. Outsourcing partners can provide advice on study design, randomization, and blinding as well as help forecast when drug products will actually be needed during the course of the trial.

Forecasting product demand is particularly important in large, Phase III studies. Upfront forecasting allows sponsors to coordinate packaging, labeling, and shipping with patient enrollment progress and treatment stages. This enables them to manage production runs, determine dispensing units and kit sizes, ensure that products are available when needed, and reduce waste from over-production.

Suppliers that also offer patient management applications can synchronize current information on patient status with forecasting software for real-time adjustments to demand forecasts.

Supply chain firms are also instrumental in helping sponsors manage drug inventory and minimise shipping costs throughout the life of the trial. Experienced professionals armed with real-time supply and demand data?available only when patient management systems are integrated with supply chain systems?can proactively make recommendations on depot locations, shipping routes, and resupply strategies. Such careful management not only saves money, but spares sites from having to store excess drug product and diagnostic kits in their facilities.

A supply chain outsourcing partner can also effectively deploy drug pooling strategies to reduce the amount of blinded supply that must be produced, and to expedite product distribution. When common inventory is held in a drug depot, IVR/IWR technology and secondary labeling specialists must work in unison to ensure supplies are labeled for the correct protocols, shipped to the correct sites, and assigned to the to correct patients.

Strategic outsourcing, whereby sponsors develop trusted and long-lasting relationships with select, key providers, can help biopharmaceutical companies meet their strategic R&D goals?particularly in emerging markets. One key to success is to rely on outsourcing partners that have sufficient scale to operate globally and sufficient breadth to integrate services across multiple functions in the trial process. The ideal supplier brings a niche domain expertise that complements the competencies of the sponsor and other providers in the mix. A formal governance structure helps guide collaboration and ensures that the relationship continues to offer transformative innovations that benefit the sponsor.

References are available at www.pharmafocusasia.com

-- Issue 19 --