The Indian pharmaceutical industry has seen an exponential growth in the field of fill finished dosage forms, especially generics but the future lies beyond generics in the field of complex generics, biosimilairs, vaccines and New Chemical Entities (NCE)/New Biological Entities (NBE). Developing NCEs and NBEs will position Indian companies in the ivy league of global innovators. Risk adverseness, lack of perseverance and complex, long regulatory approval process are impeding Indian pharma companies to venture into NCE/NBE research. Product portfolio expansion into complex generic injectables is an attractive high return alternative for the Indian generic pharmaceutical industries.

The Indian pharmaceutical industry was incepted as an API/bulk drug manufacturers which slowly diversified into fill-finish dosage form and witnessed an exponential growth in this sector for the last two decades. In the future, the focus of the Indian generic industry is to expand their portfolio into number of off-patent complex generics, bio-similar and vaccines which are hard-to-make products with a higher entry barrier. Further, complex generic drugs deliver more value to the patients by addressing additional unmet medical needs and also enable the drug manufacturer to achieve market differentiation and an opportunity to earn higher margins.

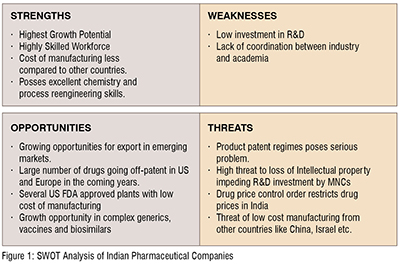

The industry is analysed for its strength, weakness, opportunities and threats (SWOT Analysis) in Figure 1. Its biggest strength is its low cost manufacturing and thereby providing costeffective medications to the entire world. Further, the highly skilled talent pool produced by various National Institute of Pharmaceutical education and research (NIPERs) located in 7 cities across the country like Mohali, Ahmedabad, Hajipur, Hyderabad, Kolkata, Guwahati and Raebareli — providing the manpower needs of the Indian pharmaceutical Industry. These scientists and engineers possess excellent chemistry and process re-engineering skills required by the generic industry.

The main weakness of the Indian pharmaceutical industry is its relatively low investment in R&D and risk adverseness. Sun Pharma Advanced Research Company (SPARC) and Suven Life Sciences had 587 per cent and 304 per cent of R&D spending to revenue ratio in the Fiscal year 2020. Other pharma companies which also figured as the largest spenders of R&D in absolute terms are Alembic Pharma and Unichem Labs, who spent between 14 per cent and 31 per cent of their revenues on R&D. The R&D spending to revenue ratio for Dr Reddy's Lab, Cipla, Aurobindo and Sun Pharma were only 11.3 per cent, 8.9 per cent, 6.3 per cent and 9.8 per cent respectively. In addition, there is a lack of co-ordination between pharmaceutical Industry and academia.

There is a huge opportunity for Indian generic companies to export to both developed nations and emerging markets. There are several USFDA approved manufacturing plants that can produce high quality, low cost generic medicines in India. Further, Indian pharmaceutical companies can gain competitive advantage by expanding their portfolios into complex generics, biosimilar and vaccines.

One of the major threat for Indian generic companies is the patent regime followed by India. An interesting point to note is that the original Indian Patents Act, 1970, did not grant patent protection to pharmaceutical products to ensure that medicines were available to the masses at a low price. Patent protection of pharmaceuticals were re-introduced after the 2005 amendment to comply with TRIPS (Trade-Related Aspects of Intellectual Property Rights).

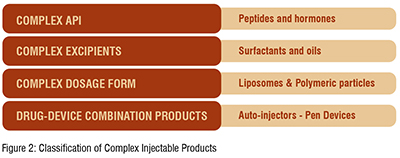

India enjoys a dominant position in global generics, it has the largest number of FDA approved manufacturing units outside the US and accounts for around 30 per cent of US generics market (by volume). However, more recently, several new entrants (including companies from South Korea and China) are seeking to establish their presence in global generics. This intensifying competition combined with significant pricing pressure clearly indicates a red zone. Indian companies have strategically responded by developing greater strengths in complex generics (a propitious niche, a blue ocean strategy). Blue oceans are defined by untapped market space, demand creation, and the opportunity for highly profitable growth without a great deal of competition as seen in the red zone (fish eating fish: a highly competitive scenario). A propitious niche is where an organisation can use its core competencies to take advantage of a particular market opportunity and the niche is just large enough for the firm to satisfy the market demand. Complex generics include complex injectable formulations (liposomal, microsphere based depot formulations), inhalation drugs (DPIs and MDIs), topical products and transdermal etc. Complex generics are products that have a complex active ingredient, complex dosage form, complex route of delivery or a complex drug-device combinations. (Figure 2)

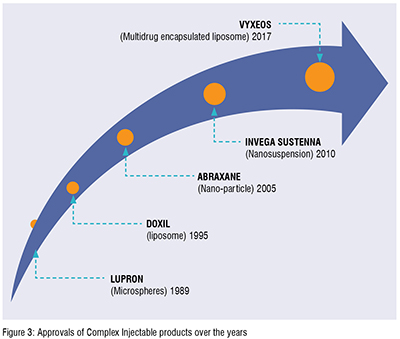

Most of the existing drugs possess undesirable physico-chemical and pharmacokinetic properties like low solubility, short half-life, high protein binding, extensive first-pass metabolism or undue toxicity, thereby limiting their therapeutic potential and overall pharmaceutical application. In the past few decades, advanced drug delivery systems like nano-suspensions, nano-emulsions, and other carrier systems like liposomes and microspheres have been explored by pharmaceutical researchers to improve the clinical outcomes of therapeutic agents through parenteral route of administration.

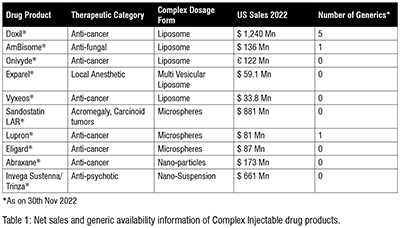

Doxil, a pegylated liposomal Doxorubicin, originally approved in 1995, has been in short supply since the production facility of Johnson & Johnson’s contract manufacturer Ben Venue Laboratories in Ohio was closed in November 2011 due to ‘significant manufacturing and quality concerns’. To address the shortage of Doxil in US market, USFDA initially allowed temporary importation of Lipodox (Sun Pharma’s pegylated liposomal doxorubicin) from India. Later, in February 2013, FDA prioritised Sun Pharma’s abbreviated new drug application and approved it. The Sun Pharma product was also given RLD (Reference listed Drug) status then. Few other generic companies like Dr. Reddy’s Laboratories Ltd and Zydus Worldwide DMCC have also received the approval for generic doxorubicin liposomes now. In recent years, few more products based on Stealth® Technology are either under development/approval stage or have seeked approval for commercial purpose. Ipsen Biopharmaceuticals Inc. received a USFDA approval in 2015 for the irinotecan liposomal injection, Onivyde®, which is also based on similar stealth liposome technology

Exparel®, approved in 2011 by USFDA, is a Multivesicular liposomal formulation (DEPOFOAM® technology) of Bupivacaine (a local anesthetic), reduces post-surgical pain up to 72 hrs post infiltration into the surgical site. Vyxeos®, approved in 2017 by USFDA (Figure 3), for the treatment of Acute Myeloid Leukemia (AML) is a dual drug (Cytarabine and Daunorubicin) loaded into small unilamellar vesicular liposomal formulation presented to tumor cells at their therapeutically synergistic ratio. Many Indian generic companies are currently exploring opportunities to develop a generic version of these two liposomal drugs without much success.

Microspheres formulations are difficult to mimic or copy because of the limited reverse characterisation data available on polymers used in these formulation like PLGA molecular weight, lactide:glycolide ratio etc. and complex manufacturing process involved. Further, these microsphere formulation require strict aseptic manufacturing facilities to scale-up. For these reasons, till date there is not many generic microsphere products in US market even after the innovator patent has expired for several products like Lupron®, Sandostatin LAR® etc.(Table 1). Recently on 29th November 2022, Cipla launched the first generic for leuprolide acetate depot 3 months, 22.5 mg, in the US market for prostrate cancer.

Zydus pioneers a breakthrough in NCE research with LIPAGLYN®, India's First NCE to reach the market. Saroglitazar is branded as Lipaglyn and marketed in India since 2013. In December 2020, Zydus Lifesciences (formerly Zydus Cadila), saroglitazar (brand name, Lipaglyn) was given fasttrack designation by the US Food and Drug Administration (FDA) to treat individuals with Primary Biliary Cholangitis (PBC), a liver disorder due to progressive destruction of the bile ducts. The drug also received orphan drug designation in January 2021. High risk involved, lack of perseverance and complex, long regulatory approval process are impeding Indian pharma companies to venture into NCE/NBE research.

Today, India is the largest provider of generic drugs globally, ranked third in terms of pharmaceutical production by volume and 14th by value. The domestic pharmaceutical industry includes a network of 3,000 drug companies and around 10,500 manufacturing units. India enjoys a competitive advantage in the global pharmaceutical sector particularly in complex generics. India also has a large pool of scientists and engineers with a potential to transform and drive the growth of the industry to great heights. Complex generic delivery systems are the latest trend in the generic pharmaceutical industry and companies that can adapt to a more holistic complicated development process are positioned to benefit greatly in the coming years. Sustainable growth going forward for Indian generic pharmaceutical Industry will be from high-barrier complex generics.

References:

1) Kanan Panchal et. al., “An expanding horizon of complex injectable products: development and regulatory considerations”, Drug Delivery and Translational Research, 14 th August 2022.

2) https://www.moneycontrol.com/news/opinion/complex-generics-no-panacea-for-indian-pharma-9202641.html

3) https://pharmaceuticals.gov.in/sites/default/files/english%20Annual%20Report%202020-21.pdf