To survive, nay, thrive in the new market, pharmaceutical companies will have to fundamentally reorganise their entire business model. All things that were traditionally considered sacrosanct R&D model, organisational design, pricing models and the much vaunted sales and marketing engine will have to be reviewed.

The old pharmaceutical industry is dead: the one that was a fully integrated behemoth, with a R&D and commercial operation regularly launching blockbuster drugs for diseases that affects millions of people. The era of the mad men in marketing and sales, strategizing with ad agencies on positioning, branding, and promotions is no more.

Today, blockbuster drugs are rarer than a snowflake in the Sahara. Regulators have defanged marketers, growth is desperately being pursued in the emerging markets, licensing is preferred over in-house R&D efforts and M&A is preferred for responding to the pressures from the street.

To survive, nay, thrive in the new market, pharmaceutical companies will have to fundamentally reorganise their entire business model. All things that were traditionally considered sacrosanct R&D model, organisational design, pricing models and the much vaunted sales and marketing engine will have to be reviewed. One thing is for certain, companies that refuse to change or those that are not able to do so fast enough will go the way of the dodo

To understand some of the fundamental forces at play, a few are highlighted are and discussed below

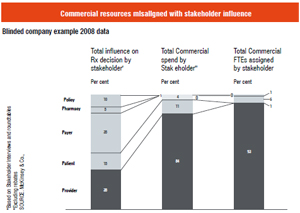

In most developed markets, the primacy of the physician as the decision maker is changing. Published data (McKinsey, 2008)show that while the role of the physician has waned, that of the payer, patient and policy has increased. There is a gap in the industry structure, that is, commercial spending and headcount are still built for the old reality.

Impact: Pharmaceutical companies have to reorganise internal resources and spend to adapt to the new stakeholder structure.

Patient advocacy and pressure groups are already driving trial designs and regulatory fast-tracking in clinical trials on oncology and rare disorders. This will accelerate with further pricing pressures and politically driven decision making on compulsory licensing to answer the clamour for accessible medications.

A prime example is the US where the Accountable Care Act is a direct response to pressures from patients (voters). While countries like India have been facing these pressures for years [drug price control order (DPCO), process patents, etc.], countries like the UK (NHS) and US (employer driven) have seen patient contribution to healthcare expenditures (through taxes or direct payment) moving towards unsustainable levels.

Impact: Patient centricity will have to move from a marketing phase to a coherent approach to manage and serve patient demands.

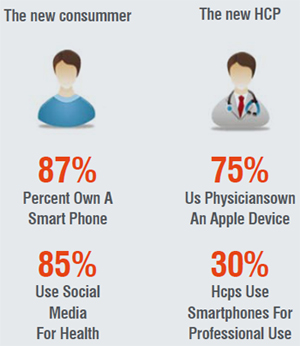

Across the world and across all age and demographic segments, internet penetration, smart device usage and social media participation is increasing. Healthcare will not be an exception to this transformation and will manifest changes in the way patients search for health information, get opinions for their diagnoses and how physicians make treatment decisions.

The nature of interactions and relationships will change with text messaging, virtual portals and telehealth becoming more mainstream. To reach physicians and other care providers, companies will have to go beyond just the sales force and focus on multichannel tools and initiatives.

Impact: Physical and virtual tools will be used to meaningfully engage customers. This will need a wholesale change from the current headcount model.

While the developed markets are likely to grow in low single digits, the emerging markets will continue to grow at 10 per cent or more for the next 5 to 10 years. For example, the largest global market, that is, the US will grow between 2 per cent and 4 per cent while Latin America is projected to grow at more than 12 per cent and India at 15 per cent or more.

Impact: Companies will have to decide what to centralise and what to localise. Reuse, cross-leverage and standardisation will become key mantras. Local infrastructure and flexibility will become critical in decision making.

Regulatory sensitivity to adverse events, me-too claims and time and cost of clinical trials have killed numerous products that may have passed muster in the past. In addition, a slew of late-stage failures have put pressure on senior management to justify internal R&D productivity to a sceptical marketplace.

The changing nature of the discovery process, complex and multifactorial nature of target diseases, coalescence of large data, omics technologies, niche marketing and the need to integrate market as well as clinical view during the discovery and development processes call out for a transformation of the insular everything made in-house' R&D culture.

Impact: Efficiency and effectiveness may lie in more open-source and network-based approaches. Now that we have had a glimpse of the tidal forces at play, what do all of the above trends portend for the new pharmaceutical industry? What are some of the key changes that are needed now?

A few key structural and strategic initiatives most of which are in various stages of initial consideration to feverish execution across leading pharmaceutical and life science organisations are highlighted below.

The competing issues of growth in emerging markets vs. contraction in developed markets mean that existing service structures will have to be reorganised to cater to the new growth drivers. The traditional notion of central headquarters trying to help out the emerging markets when possible is simply not effective, especially because they become large markets by themselves and need to be empowered to be nimble. In contrast, there is a need to drive a change in organisational mind-set, culture and capabilities to drive big shifts in areas like hybrid sales and marketing models and patient enablement.

Consequently, there are initiatives to restructure functions like R&D, regulatory and safety, medical affairs, sales and marketing and other country-operating structures as well as create new structures. Some of the key questions raised include:

What roles/functions can be centralised and aggregated and efficiencies can be scale derived?

What roles/functions need to stay decentralised?

What should be the global organisational structure? Monolithic or split into logical business units like established products, new/emerging drugs and speciality products?

Shared services and centres of excellence (CoEs) across emerging markets how are these different from those in developed markets?

What shared services need to be created to build new capabilities in the organisation and how do they partner with country units?

What change management processes need to be implemented?

Given the cost pressures, the traditional in-house model is undergoing a significant change in the developed markets, with transformational initiatives such as reduction in force, variabilisation of costs and sharing of ramp-up/ramp-down risks with service partners. New structures being tested include outsourcing and offshoring, risk-sharing models for R&D and marketing, cloud service models, software as a service and centralised platforms and technologies. All these initiatives essentially focus on converting traditional fixed costs to variable and shifting internal risks across multiple external partners and making use of prevalent industry best practices in a cost-efficient way. A key decision, especially in the context of sales and marketing, will be when to use global partners and when or where to empower country units to work with local partners. The benefits of local empowerment and agility will have to be examined against issues like risk of noncompliance and overall organisational cost.

Over the past 4 years, more than 40,000 pharma sales jobs have been eliminated in the US market alone. At the same time, the challenge is exactly the opposite in the emerging markets, where there is tremendous scarcity of trained representative along with 20 per cent to 30 per cent sales force turnover. In addition, the regulatory pressures are increasing across the world, resulting in issues of promotional compliance, standardisation of message and return on investment (RoI)..

Migration from physical sales calls to a hybrid model where sales force is augmented with multiple channels, which may include teleservices, e-mails, eDetailing/video detailing and online portals, is a smart response to the demise of the traditional model. This new multichannel marketing (MCM) model requires a centralised platform to integrate data from multiple activities, run appropriate targeted campaigns and analytics to ensure RoI. This calls for a shift in mindset from looking at MCM as just another version of a digital campaign to strategically approaching it as building a new sales and marketing infrastructure for the future. This sales and marketing infrastructure will build new capabilities and partner with country units and brand teams to drive change.

The product portfolio for many pharmaceutical companies is increasingly shifting towards rare and orphan indications, biologics and speciality products. In every one of these cases, the role of patient advocates, patient motivation and patient enablement is critical. Even in the case of chronic indications, the importance of patient adherence and compliance is a significant factor to drive clinical outcomes as well as reduce revenue leakages. Going beyond coupons and vouchers, new social media tools, multichannel engagement approaches and behavioural modelling need to be incorporated into the existing sales and marketing infrastructure.

Today's R&D models are focusing on building open or semi-open virtual networks. There are more collaboration, risk sharing and funding models. The case studies below highlight 2 two examples of the new models being explored.

How Indegene is partnering to solve the challenges and help build the new pharmaceutical industry

Indegene has been one of the pioneers in setting up hybrid global delivery models and infrastructure to deliver high value services to the pharmaceutical industry across R&D, regulatory and safety, medical and commercial functions. Leveraging a team of more than 1000 scientific, technology, analytics and communication experts across multiple delivery centres in North America, India and China, Indegene has today one of the most sophisticated infrastructures and systems to take care of pharmaceutical regulatory, compliance, data and process issues while helping clients reduce costs and drive efficiency by more than 50 per cent.

To take this initiative to the next level of sophistication, Indegene has developed a unique business innovation Extended Enterprise Model that works hand-in-glove with clients to build mirror image functional service organisations across multiple locations. The Extended Enterprises, including Extended Medical, Extended Analytics and Extended Commercial Enterprises, comprise interlocking elements, including cross-functional skills, software platforms and tools, process and training models and ability to deliver outcomes across a value-chain rather than across a single process.

With the recent acquisition of Aptilon to the portfolio, Indegene today has the leading global MCM infrastructure to deliver sales and marketing solutions across the US, EU and Emerging Markets. This cutting-edge infrastructure includes proprietary cross-channel hub platforms, call centres with tele-representatives, e-mail, SMS, eDetail and video detail solutions, recruitment tools, analytics frameworks, content, digital factories and operational support to help clients launch new products across multiple markets, augment sales force efforts to enhance uptake curves and deal with loss of exclusivity (LoE) issues.

Indegene has been successfully working with both central digital organisations and brands/therapy areas to increase the reach, improve the quality of interactions, increase the efficiency and optimise the cost. The business impact has been successfully measured across multiple dimensions, including campaign level issues like touch points, prescriptions and multi-device access metrics as well as business elements like integration efficiencies, lower time to market, operational flexibility and overall business outcomes.

Indegene believes that integrating technology platforms with service to deliver business outcomes is a key requirement for next-generation service partners. Towards this vision, Indegene has built a portfolio of proprietary IP platforms that help solve fundamental issues across R&D, regulatory, medical affairs and commercial organisations. These include:

TrialPedia: A patented clinical trial benchmarking and claim-space analysis platform with more than 200,000 clinical trials, 30+ granular search parameters and a host of analytic tools.

IndegeneConnect+ DAMS:A pharma industry-focused proprietary workflow and digital asset management platform to handle regulatory and compliance issues for digital factories, offshore production and in-house program management.

MedHost and iLearn: Enterprise learning and development platforms to help drive change in management, enhance time to market and ensure regulatory compliance.

Phynyx, Optimax and ChannelHQ: MCM infrastructure platforms that help connect multiple channels, drive campaigns and provide integrated analytics and reporting.

To conclude, it is clear that the transformational challenges faced by the pharmaceutical industry call for a fundamental Change in organisational design, cost structures, commercial strategy and service tactics are required for pharma industry's transformational challenges. More openness, partnerships, collaborations and a flexible approach will separate the winners from the losers.

-- Issue 19 --