This article addresses the first, key question in glocalisation: How should we allocate effort and resources across multiple countries? It argues that most current practice, depending on population size or GDP, is simplistic and naive. The article proposes a sophisticated multifactorial targeting approach that creates a portfolio approach to country management, so allocating the right sort of resources in the right amount to the right countries. This article therefore sets up article three, which is concerned with adapting strategies to targeted countries.

In the first article in this series, I began from the premise that as soon as any life sciences firm moves significantly outside its home market, it faces the glocalisation challenge, the dilemma between global opportunities and local needs. This dilemma simultaneously promises growth and economies of scale whilst threatening expensive failure if local needs and wants are not addressed. The glocalisation challenge can only be addressed by thoughtful, intelligent choices about where and how to compete globally. In that first article, I outlined the three major steps to glocalisation that all companies follow: targeting, tailoring and learning. I then contrasted their execution in exemplary companies with that in most companies. In this second article in the series, I go into more depth about exemplary practice in the first and most fundamental step in the glocalisation process: targeting effort across countries

If, as I do in my research, you ask many different life science companies about how they allocate effort between the 200 national markets they could target, you get near-identical answers. This is odd. It’s like every customer in a fashionable boutique store choosing the same outfit despite their hugely different body shapes, occasions and budgets. This similarity of choices might be understandable if it were the outcome of a rigorous decision process but in general it is not. Instead,these near-identical choices typically result from a phenomenon that academics call isomorphism, the instinct to do what one’s peers do. And what most firms do is to target countries according the market size or, if that isn’t known, population or economy size.

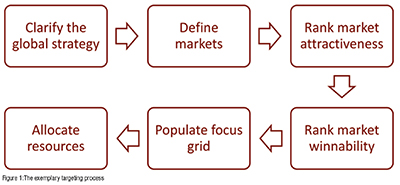

This isomorphic, “follow the heard” approach to targeting reduces the effectiveness of glocalisation in a number of ways. First, it often doesn’t focus efforts on where the most business is; a large market may have only a small accessible market and vice versa. Second, it often ignores the probability of winning; a medium sized market with weak competitors deserves more attention than a large market with a dominant incumbent. Third, it ignores interaction between markets; some markets influence whole regions’ clinical practice or market access. Despite these flaws, isomorphic targeting persists because it is easy and safe; in career terms, copying what most other people are doing is the low-risk option. Nobody was ever fired for doing what everyone else does. But if a life sciences firm wants to glocalise better than its rivals, it must glocalise differently from its rivals. This begins with allocating effort between countries differently from its rivals. Exemplary firms who target better than most companies do so in 6, sequential steps, as in figure 1.

Every disease area or brand has a core global strategy. Although it might be buried in a massive slide deck of a plan, the essence of that core global strategy is a statement of which customers to focus on and what kind of value to offer them. In pharma markets, the former is usually a context of patient, payer and professional and the latter usually a combination of clinical, economic and other customerperceived value drivers. Exemplary glocalisers begin targeting by being crystal clear about what that core global strategy is. They then use it to guide the rest of the targeting process. Those companies that begin with an unclear global strategy inevitably lose sight of the benefits of globalisation.

The next difference between isomorphic and exemplary targeting is that the former targets countries whilst the latter targets markets. Often, countries are not homogeneous and contain two or more distinct and different markets.

Countries with basic state provision and developed private provision are an example of this. The process of targeting, as described in the following steps, works best when the inputs are homogenous markets and not heterogenous countries. So exemplary companies compile a list of targets that is not the same as, and is usually longer than, their list of possible countries. Each of these potential target markets is relatively homogenous (e.g., basic state market country X, private provision market country Y). Those companies that target countries rather than markets lose sight of the complexity within countries.

The third difference between how most companies target and what exemplary companies do lies in their criteria for prioritisation. The many potential markets identified in step 2 are almost always too many for any company to attack with sufficient resource, which implies prioritisation of markets. Isomorphic targeters prioritise on the basis of size but exemplary targeters’ criterion is multifactorial attractiveness. They decide what factors make a market attractive and weight those factors. Size is typically the most important but not market size; it is size of the target segment (as identified in the core global strategy, step 1) that is considered. Then other factors are considered: synergy with other markets, rate of growth and price levels are typical factors. Whatever the attractiveness criteria chosen, a simple calculation is all that is needed to rank the potential markets list from step 2 in order of relative multifactorial attractiveness, from most to least attractive. Companies that skip step 3 take too simplistic a view of what makes a market attractive.

The fourth characteristic of exemplary targeting that distinguishes it from what most companies do is relative competitive strength assessment. This takes the potential markets list from step 2 and, like step 3, puts them in order. But in step 4 the ordering is on the basis of the company’s ability to compete in each market, relative to all the other markets. Again, this assessment involves multiple, weighted factors. Typically, the performance of the product (or product range) relative to the local market leader is the most heavily weighted factor but price, distribution strength and brand reputation are also commonly considered competitive strength factors. As with step 3, a straightforward calculation is used to order the potential markets in a list from “Most likely to win” to “Least likely to win”. Companies that skip step 4 don’t allow for their own strengths and weaknesses.

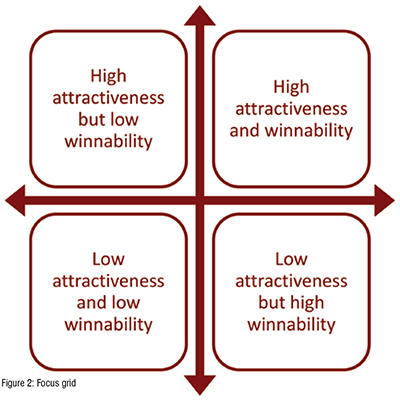

The exemplary targeting step that distinguishes it most from isomorphic practice is the focus grid. As a result of steps 2, 3 and 4, exemplar companies are now equipped with two lists. Both lists include the names of all the potential markets to which they could allocate resources (the output of step 2) but each list has those markets in a different order. One list ranks the potential markets from most to least attractive on the basis of step 3’s multifactorial, weighted calculation of attractiveness factors. The other lists the same markets from most winnable to least winnable on the basis of step 4’s multifactorial, weighted calculation of competitive strength factors. Step 5 involves combining these two lists to create a focus grid that places each market according to both relative attractiveness and relative winnability, as in figure 2. In this way, the focus grid captures all of the analyses carried out in the preceding steps. Companies that don’t use it lack the critical insight it gives.

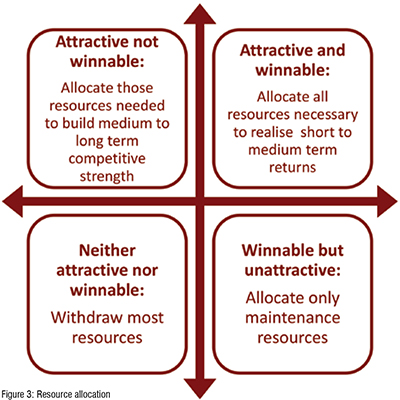

The culmination of exemplary targeting is how the analyses encapsulated in the focus grid are used to guide resource allocation. Isomorphic target leads to binary decisions (e.g. enter or don’t enter market X) or graduated decisions (lots of resource here, some here, none there) about the quantity of resource allocated. But isomorphic targeting provides little or no guidance about the qualities or nature of the resource allocated. By contrast, the focus grid guides both how much resource and what kind of resource to allocate to each market. This makes the glocalisation process more effective. Attractive, winnable markets get lots of resource of the kind needed to create short term returns, such as investment in local sales and marketing. Attractive markets where the company is relatively weak get the amount and type of resources needed to build competitiveness with the aim of medium term returns, such as establishing local distribution and building brand reputation. Relatively unattractive markets where the company is currently strong are allocated limited resources aimed at maintaining the current position, such as supporting current activity. Markets that are relatively unattractive and hard to win are treated opportun istically, with minimal resources allocated only to seize unexpected chances, such as competing for binding tenders. If unattractive markets are currently allocated large resources, these can be diverted to attractive markets. The guidance implied by the focus grid is summarised in figure 3.

I hope it is obvious that the exemplary, six step process described in this article is significantly different from the isomorphic process that is typical of the life sciences industry. I hope too that the advantages of its more careful nalyses and more structured approach are clear. Done well, this process avoids the three dangers of isomorphic targeting, described above. By intelligently allocating resources between markets, it gives exemplary companies a solid foundation on which to build their glocalisation strategy. But intelligent targeting of resources is only the first step in an effective glocalisation process. Exemplary practice also differs from isomorphic practice at the tailoring and learning stages. I will address those differences in the next two articles in this series.