The pharmaceutical industry is a complex adaptive system whose past is explained and future predicted by evolutionary science. New research into this area predicts the speciation of pharma business models. For industry CEOs, this implies difficult choices about which part of the industry habitat to occupy and how to guide the evolution of their company\'s business model.

To predict the future of pharma, we need a powerful tool and fortunately, in evolutionary theory, we have what philosopher Daniel Dennett called the best idea ever. First used to understand the complexity of life, evolution is now used by management scientists to explain and predict many other complex adaptive systems, including whole industries. Evolutionary economics equates business models with species and the changing natural environment with variations in the market context. With valuable clarity, it accounts for the history of our industry and allows us to predict the future of pharma.

The application of evolutionary theory begins by understanding that the pharmaceutical industry is not simply evolving; it is co-evolving with its scientific and sociological environments. In the latter, demographics, globalisation and the attitudes of governments, patients and investors are among the many factors that are re-shaping who pharma's customers are and how they define value. For most of the past 100 years, pharma's customers have been governments and insurance providers in the so-called developed world, who defined value as the best clinical outcome. A dramatic shift towards value defined as the best health-economic outcome is already visible, but that is only the start of the change to be expected. As demand outstrips what governments can pay for, organisational payers will retreat into providing a core service. Above and below state and employer provision, individuals will purchase their own healthcare. When the new rich use their wealth to prolong and enhance their lives and mass consumers sacrifice consumer goods to co-pay and self-medicate, the pharmaceutical industry will have three customer habitats of significant importance. In each habitat, value will be defined in a different way and it will no longer be sufficient to operate one business model.

Similarly, pharma's market will also be fragmented by the co-evolving technological environment. The most obvious biological science trends, such as genomics and systems biology, will make possible fantastic new therapies. But other, non-biological sciences will be just as important. Nanotechnology and the spread of information technology to are just two examples of non-pharmacological technological change that will reshape the way healthcare value is created and delivered. And beneath these headlines will be the application of technology to how pharmaceutical companies work, allowing them to restructure and become hyper-efficient. This will lead to a three-way polarisation of the way pharma companies create value. New science will remain a value creator for the industry, but it will also become possible to create value by tailoring healthcare to the patient and by reducing the costs of treatment to a tiny fraction of today's prices. Scientific innovation, personalisation and low-cost business models each exist today, of course, but they will evolve far beyond current ideas and, compared to today's models, will have a more equal balance between prevention and cure.

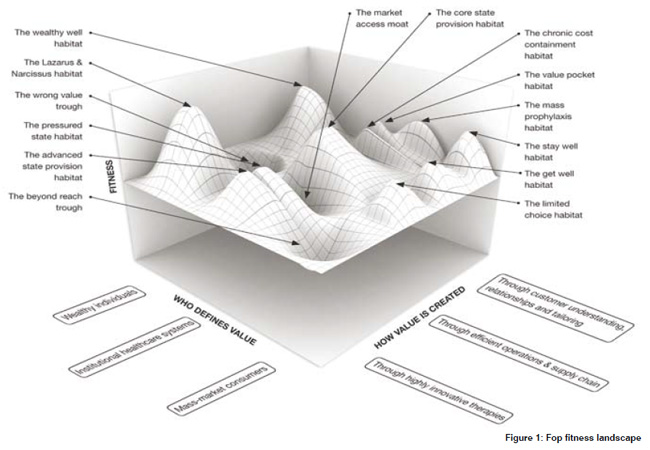

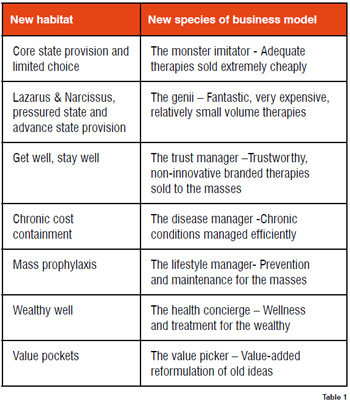

The next step in understanding the evolution of pharma's business models is to grasp that its new habitats are formed at the intersections of sociological and technological change. Customer's new ways of defining value will combine with novel ways of creating value, creating a new landscape of market habitats. Evolutionary theory predicts a complex landscape will emerge with no fewer than eleven fitness peaks, analogous to ecological niches, and three troughs, analogous to evolutionary dead-end s(see Figure 1).This fragmentation of the business environment has huge implications for the industry's structure, the first of which this is a relatively small habitat and likely to be extremely crowded. A more rational, successful leader will discount ego and consider carefully which of the seven models fits closest with their firm's current capabilities and organisational culture.

Self-knowledge: To make the right choice of habitat and model depends on understanding objectively what the strengths of the organisation truly are. For example, firms may perceive themselves to have strengths in discovery when their true strength lies in the trust their corporate brand has acquired over decades. A firm that truly understands its strengths would therefore make different and much better choices than a firm that is deluding itself.

The second CEO decision concerns what new capabilities the new business model implies. Research shows that the new capabilities needed by the pharma company of the future fall into three categories:

Core capabilities are those needed just to operate in a market; they confer no advantage but lack of them means certain failure. In the future of pharma, these will include negotiating complex regulatory and market access problems and managing the perceptions of a cynical, media-led public. But they will also include understanding increasingly complex customer networks of payer, prescribers and patients and, compared to today, developing frugal business processes.

Distinctive capabilities are those that will allow firms to compete and, importantly, they are different for each of the seven business models. The value-picker model, for example will have to excel at spotting niche opportunities. The lifestyle manager, by contrast, will need to develop complex, integrated value propositions rather than simple products

Dynamic capabilities are those that enable change in the organisation and as such are the most precious and problematic. They will include practices that allow firms to create market insight, build on that insight to create strong strategies and to execute them via complex alliance networks.

The third, and perhaps most difficult, question for CEOs to address is how to develop these new capabilities faster than the competition. Evolutionary theory suggests three important factors will determine the speed at which firms will evolve. Firstly, the capabilities needed will be very different from today; second, the practices needed will vary greatly between business models; and finally, many of these practices will not come from pharma industry but from other sectors. These three factors have important implications for how the most successful firms will acquire their new practices. For example, almost always pharma's instinct is to borrow industry best practice from other pharma companies, believing the industry to be special or unique. This is the corporate equivalent of incest and it simply re-circulates the same old practices. To achieve a rich, varied injection of new practices, pharma will need to learn how to import ideas from many other sectors and break its habit of corporate incest.

This article attempts to summarise the extensive, radical findings of a very large scale research project into the future of the pharmaceutical industry. Modern ideas of evolutionary economics predict a complex, fragmented market landscape that will drive the evolution of several new business models and the extinction of the ones were familiar with. That prediction of speciation and extinction both identifies and guides the decisions that need to be made by the industry's leaders. If they make and implement the right decisions, the pharmaceutical industry will continue to contribute hugely to our society. If they fail, both our society and the industry will be much the worse for it.

-- Issue 19 --